How to activate a Suspended GST Number?

The rule 23 of the CGST Rules got you confused? Don’t worry, we got you! In this blog, we discuss in detail how to activate a suspended GST number.

You would surely know the steps to activate your suspended GST number in this blog but what about the GST records and files? Believe us, Lio App will help you manage all your records and data at one place and in your hands.

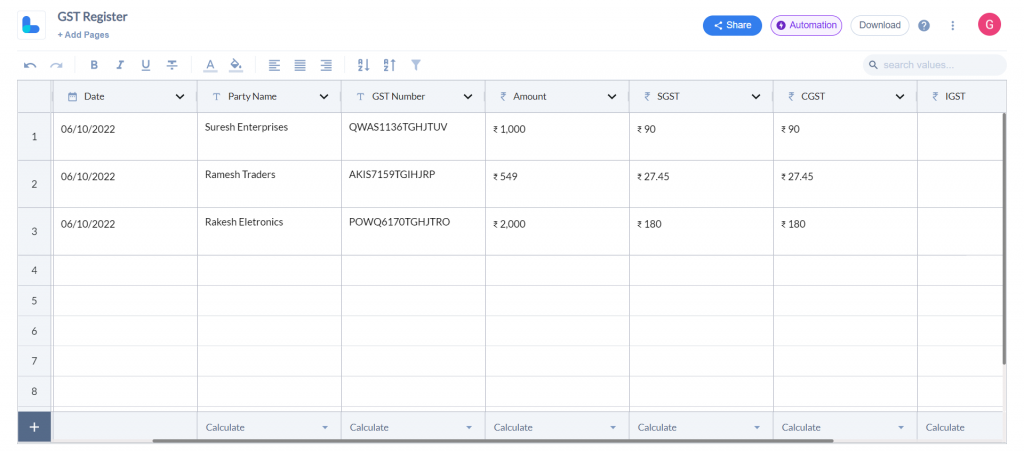

Check out the screenshot below and see how easy the account management is with simple readymade GST register.

This article focuses on how to reactivate a GST registration that has been cancelled. This article will guide you in reactivating a GST number that has been cancelled. How can you resubmit an application for GST Registration Cancellation Revocation?

The official declination of a decision or promise is termed a revocation. It implies that the decision to terminate the registration has been overturned, and the registration remains valid. If you file your revocation within the necessary time frame, you will be allowed to revoke your cancelled GST registration; otherwise, you will not be able to do so.

Within 30 days of requesting cancellation, you must submit a revocation form. Revocation is only possible when the authorities cancel the GST certificate; if you cancel your certificate, you cannot revoke; revocation is only possible when the authorities cancel the GST certificate.

How to Activate a Suspended GST Number?

What does it mean to have your GST registration suspended?

The government has designed the new concept of GST registration suspension. The CGST Rules 2019 have been amended to include Rule 21A. A taxpayer who has sought GST registration cancellation will no longer be required to comply with GST return filing requirements during the suspension period, owing to the establishment of this regulation.

The GSTN has lately begun sending text messages to taxpayers warning them of inconsistencies in their GST filings. A new sub-rule 2A has been included in Rule 21A of the Central Goods and Services Tax (CGST) Rules, according to Notification 94/2020 dated December 22, 2020.

Any major discrepancies or inconsistencies found between the GSTR-3B and the GSTR-1/2B might result in GST registration being suspended. Furthermore, if these discrepancies are not resolved, the GSTIN may be terminated.

Furthermore, if the taxpayer has requested cancellation, the tax office has the authority to suspend the registration until the cancellation process is concluded, as per the terms of new Rule 21A, which was adopted by Notification 94/2020.

Whose GST registration or GSTIN is at risk of being revoked?

A proper authority can only cancel a registered person’s GSTIN if he has cause to think that the registration should be terminated. The relevant authority shall provide the registered person with a fair chance to be heard before proceeding with the cancellation procedure outlined in Rule 22 of the CGST Rules 2017.

The appropriate officer has the authority to suspend the registration while such cancellation proceedings are being carried out. That’s why you should know the advantages and disadvantages of GST before filling it.

He can issue form GST REG-31 to notify the taxpayer of any inconsistencies. He will also state that if a valid explanation for the differences is not supplied, the registration may be terminated.

He can also suspend the registration with effect from the date of this communication to the taxpayer, as per Rule 21A(2A). Furthermore, if the relevant authority receives a good response from the taxpayer, the suspension might be lifted.

The clause relating to the suspension of GST registration until cancellation was appreciated by taxpayers since it relieved them of their compliance burden until the cancellation processes were completed.

What is the duration of the GST registration suspension?

Any registered taxable person has 30 days from the date of service of the order of cancellation of GST registration to request for revocation of GST registration cancellation.

It should be mentioned that an application for revocation can only be made in the event that the proper authority has terminated the registration on their own initiative. As a result, revocation cannot be invoked when a taxpayer voluntarily cancels his or her GST registration.

Application for Revocation

The registered person must submit an application for revocation of GST registration in FORM GST REG-21, either directly or through a facilitation centre designated by the Commissioner.

Revocation of Cancellation: Online Application Procedure

Taxpayers must undertake the steps outlined below to revoke or cancel their GST registration online.

- To begin the Revocation of Cancellation of GST Registration process, taxpayers must first go to the Goods and Services Tax site.

- To go to the username and password screen, click the ‘Login’ button.

- Click ‘login’ after entering the right ‘Username’ and ‘Password’ credentials, as well as the captcha in the required box.

- Simply go to the services tab on the home page and select the Revocation of Cancellation of GST Registration link.

- The portal directs to the next page once you click the link, where you must provide the reason for revocation of cancellation in the ‘Reason for revocation of cancellation’ box.

- Then, to attach any supporting documents, click the “Choose File” option.

- Now Check the box next to Verification.

- In the Name of Authorized Signatory drop-down list, choose the name of the authorised signatory.

- In the Place area, you must provide the address where the application is lodged.

- You can also store the application form and retrieve it later by clicking the ‘save’ option.

- Use the Submit with DSC or Submit with EVC buttons to submit your work.

- Use your Digital Signature Certificate (DSC) or the EVC option to sign the form. You will receive an OTP if you choose any of these options.

- The system will produce the ARN and display a confirmation message after successfully filing the application for cancellation of registration.

- Your registered mobile phone number and e-mail address will also get a confirmation message from GST Portal.

Approval from the Tax Office

- The appropriate authority may reverse the cancellation of the GST registration after obtaining the essential information and being satisfied with it.

- The system produces an approval order based on the Tax Official’s permission and notifies the applicant, the taxpayer’s Primary Authorized Signatory, through e-mail and SMS.

- The GSTIN Status of the taxpayer will change from Inactive to Active with effect from the effective date of cancellation if the Application for Revocation of Cancelled Registration is approved.

Rejection by the Tax Office

- The rejection order is issued when the Tax Official rejects an application for revocation of cancelled registration.

- The GSTIN status on the GST Portal will remain “Inactive,” and the taxpayer will get notification from the Primary Authorized Signatory through SMS and email that the application has been rejected.

- On the taxpayer’s dashboard, the Rejection Order receipt can be accessed.

Also Read: A Detailed Guide on GST, Tax Slabs, and Its Impact

Revocation of Cancellation: Offline Application Procedure

The application for revocation of cancellation can also be submitted online by following the given steps:

- If a registered taxpayer’s registration has been revoked suo moto by the competent tax official, he can file the FORM GST REG-21 application for Revocation of Cancellation of GST Registration either directly or through a facilitation centre authorised by the Commissioner. The GST portal has this FORM GST REG-21 available for download.

- You have 30 days from the date of issuance of the cancellation order through the Common Portal to submit the application.

- The authorised officer may rescind the cancellation of the registration if they determine that there are valid reasons as defined by the Act. Within 30 days of receiving the application, the officer will respond using FORM GST REG-22. All information for revocation or cancellation of registration must be recorded in writing by the official.

- The proper authority must make a decision within 30 days after receiving the applicant’s clarification in FORM GST REG-24.

- Before rejecting a revocation application, the responsible GST officer must send a notification in FORM GST REG-23. Within 7 working days of receiving the notification, the applicant must submit a satisfactory response in FORM GST REG-24. After receiving a proper answer from the applicant, the concerned officer must issue an appropriate order in FORM GST REG-05 within 30 days of receiving the applicant’s response.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio Can Help?

Lio is a mobile integrated app that helps in maintaining the records of the activities as well as used for storage of other personal data and keeps it safe and secured so that the users know that their data will not get corrupted from any outer source. The app helps in categorizing, making folders, and storing data of various activities.

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Frequently Asked Questions(FAQs)

Who is Ineligible for Filing a Revocation of Cancellation?

UIN holders (i.e. UN Bodies, Embassies, and Other Notified Persons), GST Practitioners, and those whose registration has been revoked on the taxpayer’s or legal heir’s request are not eligible for revocation.

What are the Consequences of getting your GST number cancelled?

There are two Consequences of Getting your GST number cancelled-

1. The taxpayer will no longer be required to pay GST.

2. GST registration is required for some companies. If the GST registration is cancelled but the business continues, it would be considered a GST violation with severe penalties.

Why will an Officer cancel a GST number?

A Tax Officer can cancel a GST number for a variety of reasons such as when a vendor:

1. Does not do business from the stated location of the business

2. Without the provision of goods or services, issues an invoice or bill

Violates the anti-profiteering laws

3. With certain exclusions, taxpayers who violate Rule 86B and have a total taxable value of supply exceeding Rs.50 lakh in a month and might be using 4. ITC from their electronic credit ledger to discharge more than 99% of their tax burden.

5. A taxpayer who is unable to file GSTR-1 because GSTR-3B has not been filed for more than two months.

6. Makes use of the input tax credit in contravention of section 16 of the Act or the regulations.

When is a Revocation of Cancellation Applicable?

It only applies when a tax official cancels a taxable person’s registration on his own initiative. Within thirty days of the cancellation order, the taxable person can apply to the officer for revocation of the cancellation.

I applied for Voluntary GST Cancellation a few months ago, and it was granted by my GST officer. Now I would like to restart my business. Is it possible for me to file a GST revocation request?

GST Revocation requests are only accepted if the GST Officer has revoked the registration of his own will. You could not apply for GST Revocation if your GST Registration was cancelled at your request. You must submit an application for a new GST registration.

How to cancel GST Registration if Business Turnover is below the Threshold Limit?

If you want to cancel your GST registration, you must submit an application to your GST Officer online in the prescribed form, indicating why you want to terminate your GST registration. Within 30 days of dissolving your company, you must request for GST cancellation.

Conclusion

This article talked in-depth about the implications of GST number cancellation as well as ways to re-activate it. An application for revocation of cancellation can be submitted both online and offline. Both the methods were elaborated in a step-by-step manner.

Revocation of a cancelled GST registration is only possible within 30 days of the order of cancellation being served, and only if it was done by the GST authorities; otherwise, it will not be revoked. The online method is faster than the offline procedure, and it is also easier and simpler.

To file your application for revocation of GST registration, hop on to the official GST website. You must include your cause for revocation in your application and then submit it on the website. If the concerned officer finds your reasons to be sufficient, the officer will revoke the cancellation of your GST number.

In the article, I have listed down all the important segments for you to understand everything when it comes to activating a suspended GST number. Hope it is helpful to you and answers all your questions.

10 Comments

I recently came across a SEZ article. Could you please elaborate on it for me?

Hello Viswajith,

A special economic zone (SEZ) is a portion of a nation that has distinct economic rules than other parts of the same nation. A country or person often receives additional economic benefits when doing business in a SEZ, such as tax breaks and the chance to negotiate cheaper tariffs.

Foreign direct investment is often encouraged by and attracted by the SEZ economic policies (FDI). Any investment made by a company or individual into commercial interests situated in another country is referred to as an FDI.

Please let me know if we can reapply for GST registration if it was denied the first time. Big thanks!

Hello Paras,

If your application for GST registration was denied, you will have the opportunity to respond to the denial letter. However, you would need to wait for a final rejection, which will take about 10 days, if you wanted to submit a fresh application.

Could you please explain the composition scheme under GST, what it entails, and who is eligible for it? Thanks..

Hello Varun,

The Composition Scheme is a basic and simple GST scheme for taxpayers. Small taxpayers can avoid time-consuming GST formalities by paying GST at a certain percentage of turnover instead. Under the GST composition structure, not everyone may register. People whose annual income is up to INR 1.5 crore in a fiscal year are considered taxpayers. The composition scheme’s main goals are to make things simpler and lower small taxpayers’ compliance costs.

This article is absolutely wonderful and filled with useful information. I really appreciate it. Continue to write more.

Hello Dalsa,

Thank you so much for your kind words.

I am delighted that you found this article useful and I’ll definitely write more on pertinent subjects.

Please let me know what cancelled suo-moto is in GST. Many thanks.

Hello Rohan,

Suo moto cancellation of a GST registration refers to a request for cancellation of the registration made by the tax officer. The CGST Act’s requirements, however, require that the officer give his justifications for initiating such suo moto revocation of registration (Section 29(2)).