How to Upload Purchase Invoice To GST Portal

Due to India’s largest-ever tax reform, GST has made doing business much more accessible while also increasing the country’s taxpayer base by bringing millions of small enterprises under a single standard tax structure. This article will cover all the points on how you can upload your purchase invoice to the GST portal.

Introduction

The GST regime demands the registration and acquisition of the GSTIN for all companies involved in purchasing or selling goods or services, or both.

What does GSTIN stand for?

In India, each taxpayer with an active GST registration receives a 15-digit code called a GSTIN. Every taxpayer has a unique code determined by the state where they live and their identification number (PAN). There are so many Advantages and Disadvantages of GST in India which you can filter out after reading this article.

Businesses with yearly revenue of more than Rs.20 lakh are required to obtain a GSTIN. The GSTIN is necessary for companies that use an e-commerce platform to conduct business.

If your business expects to make more than the authorized revenue, you must register for GST. GST registration is also required when you start a new business.

Who is Qualified to Register for GST?

Businesses that fall within the following categories are needed to register for GST.

To receive GST Registration, a service provider must supply services valued at more than Rs.20 lakhs in a year as a whole. However, a business that solely deals in the supply of commodities and has combined annual revenue of more than Rs. 40 lakh is obliged to register for GST.

If a company is involved in goods from one state to another, it must register for GST in India.

Anyone who sells goods or services on an e-commerce platform should register for the Goods and Services Tax (GST). No of how much money they make, everyone must be GST registered.

GST registration is essential for anyone who supplies goods or services through a temporary stand or shops seasonal or intermittent. Regardless of how much money someone earns, they should register for GST.

Previously, an entity with a voluntary GST registration could not renounce its GST registration for up to a year. Now, an entity can receive GST registration voluntarily. Voluntary GST registration can now be revoked at any time by the applicant due to recent changes.

GSTN To Upload Purchase Invoice Specifications

Each month, the taxpayer should upload data of all invoices issued during the previous month to the GSTN portal to submit the GSTR-1 Return. The taxpayer is responsible for uploading to GSTN in data format only the information related to the invoice.

For large B2C bills, the following data must be uploaded to the GSTN: Large B2C accounts are those with a taxable value more significant than Rs.2.5 lakh.

The GSTN must be updated with the following information for B2B invoices:

GTINs of clients

- Number of Invoices Date

- Supply Point

- Value of the Total Invoice

- Type of provisioning (Inter-State or Intra-State)

- If the supply is made via an e-commerce operator, the e-commerce operator’s GSTIN must be disclosed.

- Each GST rate slab has a taxable value.

- The relevant GST amount (IGST, CGST, and SGST)

For large B2C bills, the following data must be uploaded to the GSTN: Large B2C bills are those with a taxable value more significant than Rs.2.5 lakh.

- Number of Invoices Date of Invoice

- Supply Point

- Value of the Total Invoice Type of Supply (Inter-State or Intra-State)

- Suppose the supply is made via an e-commerce operator.

In that case, the collection is made at the GST rate applicable to the e-commerce operator’s GSTIN (0 per cent, 0.25 per cent, 3 per cent, 5 per cent, 12 per cent, 18 per cent, and 28 per cent ).

If an invoice contains many products, the rates for the individual items can be merged.

- Each GST rate slab has a taxable value.

- The relevant GST amount (IGST, CGST, and SGST)

- On the GSTN, only aggregated rates for B2C small invoices must be uploaded. Thus, individual invoices do not need to be uploaded for B2C invoices with a taxable value of less than Rs.2.5 lakhs.

GSTN Invoice Upload: Step by Step Guide

GSTN invoices can be uploaded in a variety of ways and with a variety of instruments.

Software for GST Analysis and Reporting by LEDGERS

Businesses that file GST returns using LEDGERS GST Platform can also upload GSTN invoices through the software.

GSTR-1 will be automatically prepared based on the invoices generated by LEDGERS.

LEDGERS’ excel upload function can be used to import any additional invoices that a customer has received. GST Filing – GSTR-1 – The user can access the overview once all of the invoices for the month have been filed to LEDGERS.

Clicking on File GSTR-1 will take you directly to the GST Portal, where you may complete and submit your GST Return. The user must enable LEDGERS access to the GST Account and validate the same by using the OTP obtained to file directly.

Alternatively, a JSON file including all the details for filing GSTR-1 and uploading invoices can be downloaded from LEDGERS by the user.

Complete the GST filing through LEDGERS by uploading and digitally signing this file on the GSTN.

Uploading an Invoice Manually on GSTN

Manual uploading of invoices to the GSTN site is also an option for those with a GST account. Follow these steps to upload an invoice to GSTN manually:

Step 1: Begin by logging in to your GST account.

Step 2: Choose the month for which you want to upload GST invoices.

Step 3: Pick GSTR-1 from the drop-down menu. Return to the page and select Prepare Online from the menu.

Step 4: Posting B2B Invoice Information in Step 4

This strategy would be most beneficial to small firms with a limited number of invoices to handle each month.

Because each invoice’s details would have to be manually entered into the system, this would be a time-consuming and cumbersome alternative for organizations with a large number of B2B bills.

Also Read: Everything about GST emSigner Error

Step 5: Add the B2C Large Invoice Information to Your Account.

Once the B2B invoices have been uploaded, the user will complete the B2C important invoice information. Users will have an easier time posting large B2C invoices because there are only a few details required.

Besides the B2B bills and B2C large invoices, the taxpayer should upload other consolidated information such as B2C small invoices, credit or debit notes, and advances received, etc.,

while uploading the documents in question. As a result, taxpayers should only submit big B2B and B2C invoice data to the GSTN.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How can Lio help?

Lio is a mobile integrated app extremely useful to organize all data in one place and have access to it with just one tap anywhere. Lio can help in keeping track of the taxes paid for the different goods and services.

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

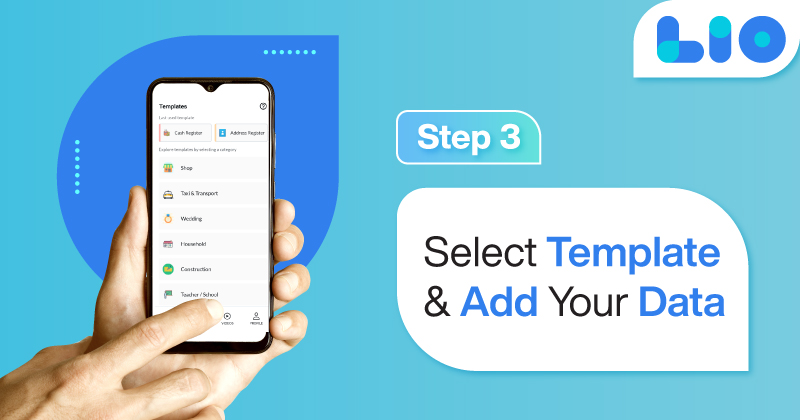

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Alternatively, if you choose to prepare your GSTR-1 return manually, you can do so by accessing the GST offline return tool available on the GST platform.

The GST offline return program is a .exe file that runs on Windows-based PCs and allows you to file your GST return offline. When using the offline GST return tool, the taxpayer can obtain all of the essential information, as well as the attached invoice, for GSTR-1 without having to go online.

After completing all of the necessary information, the user can click on the download JSON option to obtain a JSON file containing all of the B2B invoice data as well as the GSTR-1 return information. Following that, the user can upload the file directly into the GST portal, which will finish the GST return filing process for them.

Frequently Asked Questions(FAQs)

What exactly is E-Invoicing, often known as Electronic Invoicing?

A system in which the taxpayer uploads his invoice data and registers his supply transaction on the Government Invoice Registration Portal (IRP) to obtain an Invoice Reference Number (IRN), which is created by the IRP system, is referred to as “e-invoicing” or “electronic invoicing.”

What is the minimum annual turnover required for E-Invoicing to be applicable?

To prepare an E-Invoice, the threshold turnover amount is Rs 500 crores, according to Notification No. 61/2020 – Central Tax dated 30th July 2020.

This year’s financial year’s turnover will be computed at the PAN level (i.e., for all GSTINs combined) to be used for E-Invoicing calculations.

How can I find out if my company is eligible to be registered for electronic invoicing?

Turnover of Rs 500 Crores or more is required for the preparation of an E-Invoice. Any entity that has been identified for E-Invoice implementation can check the status of the implementation at the following link:

https://einvoice1.gst.gov.in/Others/EinvEnabled by submitting their GST number on the E-Invoicing Portal.

What kind of papers is eligible for electronic invoicing?

The following documents must be submitted to the electronic invoice system by the taxpayers.

Supplier’s Bill of Lading

Supplier Issues a Credit Note

Supplier Issues a Debit Note

Will the e-invoice schema be able to accommodate the reverse charge mechanism?

Yes, the e-invoice system includes a reporting mechanism for reverse charge mechanisms as well.

What are the different supply kinds that are available in the e-Invoice Portal?

The following are the different supply kinds that can be reported: B2B: Small Business to Business (SB2B), To SEZ with Payment (SEZWP), To SEZ without Payment (SEZWOP), EXPWP (Export with Payment), EXPWOP (Export without Payment), DEXP (Deemed Export), Consumer to Customer.

Who is in charge of the creation of the electronic invoice?

The IRN for the supplies/sales must be generated by the taxpayers who have been notified.

The IRN must be produced for all invoices, debit notes, and credit notes issued for local, interstate, and international transactions, as well as for export transactions.

The taxpayer must upload the complete invoice details, which can be prepared manually or through an internal ERP/accounting system, following the format, and after the data has been properly validated, the system will return the IRN, along with the signed invoice and QR code, to the taxpayer for further processing.

The IRN, ACK No, date, and QR code must all be printed by the taxpayer on the invoice that is sent to the customer for it to be valid.

It should be emphasized that the IRN can only be generated by the provider and cannot be generated by the customer or the transport company.

Is it possible to cancel an e-invoice?

If an active e-way bill is not present, the user has the option to deactivate the IRN by logging into their account.

If the e-way bill is not generated or if the e-way bill is canceled after it has been generated, the user has the option to cancel the E-Invoice.

It is only possible to cancel the invoice on its whole. It is not possible to cancel an invoice in part.

I have an account with the E-Way bill site. Is it necessary to create a different login for the E-Invoicing Portal?

To access the e-invoice system, you must first log in to your account. Logging onto the e-way bill and e-invoice systems have been made possible through the implementation of a Single Sign-On (SSO) system.

In other words, if a taxpayer already has a username and password set up on the e-way bill system, they can use those credentials to get into this system as well.

I do not have access to the E-Way Bill Portal because I do not have a login ID and password. What is the procedure for creating a login for the E-Invoice Portal?

It is possible for a taxpayer who has not yet enrolled in the electronic waybill system to do so by utilizing the registration facility and registering for the electronic invoice system.

The technology then automatically grants him access to both the e-way bill and the e-invoice systems. Visit https://einvoice1.gst.gov.in/ for more information about registration and other services.

10 Comments

Please let me know how to reject credit notes in GST.

Hello Nishana,

According to Section 34 of the CGST Act of 2017, the supplier of the products must issue a credit note for the goods that are being rejected and must record this credit note in GSTR-1. Once the seller files the credit note, the GST amount will appear in our GSTR-2 and diminish the amount of ITC we are eligible for.

You’ve detailed how to upload a purchase invoice in detail, including step-by-step instructions. Thank you a lot.

Hello Likhith,

Thank you for your warm words.

I’m delighted this article was informative to you.

Could you kindly let me know if e-invoices are mandatory for B2C?

Hello Maneesh,

B2C invoices are not currently subject to electronic invoicing. To enable digital payments on all B2C invoices, a taxpayer must create a dynamic QR code, as per Notification No. 14/2020-Central Tax, as amended by Notification No. 71/2020-Central Tax.

Describe the e-way bill for me, please. What is one’s validity? Please let me know.

Hello Parvathy,

Electronic Way Bills (E-Way Bills) are essentially a compliance method in which the person responsible for the movement of goods uploads the necessary data before the movement of the products begins and generates an E-Way Bill on the GST portal.

Before you create an e-way bill, you should learn everything there is to know about it. The e-way bill’s validity is determined by the distance the products must be transported. For every 100 KMs or portion of its movement in the event of a standard vehicle or transportation method, one day’s validity has been offered.

Please explain what reverse charge mechanism in GST entails, would be useful for me. I’m also a big fan of your work.

Hello Vishnu,

thank you for your warm words.

GST is normally collected by the person selling goods and services. However, in some cases, the purchaser of goods/services must collect GST rather than the seller. This is known as the Reverse Charge Mechanism, or RCM for short.