Udyog Aadhaar Registration Process, Documents, Benefits and More

The idea behind introducing Udyam Registration, earlier known as udyog aadhaar, was to simplify the procedural format that business owners had to go through to register their business under Micro Small Medium Enterprise or MSME.

Before this, the process for the same was very tiring, time-consuming, and hectic that required a lot of paperwork. But since Udyam Registration has come into the picture, things have changed a lot and have improved for micro, small and medium enterprises.

If you own a medium, small or micro-enterprise and you haven’t registered your MSME yet, know that on registering via Udyam Registration, you will be liable to enjoy numerous benefits.

Prior to the UAM system, there used to be a former system of EM-I/II (Entrepreneur Memorandum) under which, entrepreneurs used to opt for a heterogeneous system.

Some also relied on the national portal, and some of the states had their portal for carrying out MSME registration. Additionally, Few of them used to rely on manual paperwork.

But things have changed a lot since the replacement of the old system.

What Is Udyam Registration?

Udyam Registration also known as MSME Registration is a government registration that is provided along with a recognition certificate and a unique number to certify small/medium businesses or enterprises.

The main reason behind this was to offer a way for the government to provide the maximum benefits to medium or small-scale businesses or industries in India, who are registered via MSME through their Aadhar Card Number.

The owner, director, or proprietor of the entity will provide his/her 12-digit Aadhar Number. It should have the recognition certificate provided via the MSME registration process.

Udyog Aadhaar Registration Process

The process of Udyam Registration is quite easy, and the form-filling process is pretty straightforward too. It’s important to note that MSME Registration is free of cost and the website does not charge any official fee for issuing a registration certificate.

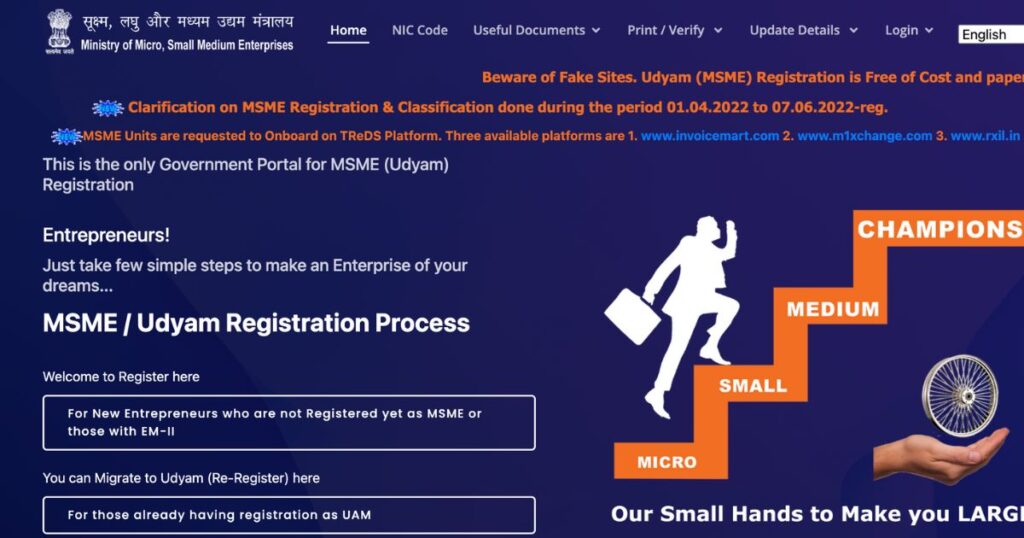

Step 1: Visit the Official Website

The very first step for getting your business registered online will be on visiting the official Udyam Registration portal.

Click on the “For new Entrepreneurs who are not registered yet as MSME” option.

Step 2: Enter Your Personal Information

Enter your unique Aadhar number. Click on “Validate & Generate OTP.” Enter the OTP sent to your registered mobile number.

Step 3: PAN Verification

Select the type of organization and enter your PAN no and click on validate. PAN validation takes place.

Step 4: Filling Correspondence Details

Give the complete postal address of the company/enterprise/entity. Also info about your company’s district, pin code, state, email address, and mobile number.

Step 5: Fill in the Bank Details

Enter your enterprise’s active bank account number along with the IFSC code of the concerned branch.

Step 6: Enterprise Details

Mention the mainline activity of your enterprise from the “services” or “manufacturing”. Submit the total number of persons employed and the National Industry Classification(NIC) Code for Activities.

The last thing will be entering, the total amount of money(in lakhs) that you have invested in your machinery or plant.

Step 7: Select the District Industry Center and Accept the Declaration

In the final step of this process, select the district industry center from the provided drop-down list. Accept the declaration and click on “Submit and Get final OTP”

Enter the OTP received on mobile and click on the “Final Submit” button.

Once you click on ‘Submit and Get Final OTP’ you will receive a registration number. Once all your information is verified by the Government, you will receive an E-registration document on your e-mail id.

Documents Required for Udyog Aadhaar Registration

To register, you would require a few documents. Here’s a list of them to refer to:

- Only the Adhaar Number will be enough for registration.

- PAN & GST linked details on investment and turnover of enterprises will be taken automatically from Government databases.

- Having PAN & GST number is mandatory from 01.04.2021.

Benefits Of Udyog Aadhaar

You will have many advantages after registering your business and by obtaining Udyam Registration. Here are the top benefits that you will enjoy:

- Helps in getting government tenders.

- Cheaper bank loans as the interest rate is very low (up to 1.5% lower than interest on regular loans.

- Various tax rebates are available for Udyam.

- Becomes easy to get licenses, approvals, and registrations, irrespective of the field of business. Higher preference is given to businesses registered under Udyam for government licenses and certifications.

- Easy access to credit at lower interest rates.

- Get tariff subsidies and tax and capital subsidies.

- Helps in the reduction of the cost of getting a patent done or the cost of setting up the industry. With the help of many rebates and concessions available.

Who Can Apply

The organizations eligible for Udyam Registration must either be in manufacturing, processing, preservation of goods, providing the services, or producing. In other words, traders who buy, sell, import, or export the goods are not even eligible for applying for Udyam Registration.

The criteria that an entity has to meet to be classified as a medium, small, or micro-enterprise for obtaining MSME registration are:

Micro Enterprises

Investment up to Rs 1 Cr and turnover up to Rs 5 Cr

Small Enterprises

Investment up to Rs 10 Cr and turnover up to Rs 50 Cr

Medium Enterprises

Investment upto Rs 50 Cr and turnover upto Rs250 Cr

What Is Udyog Aadhar Memorandum

Udyog Aadhaar Memorandum is a registration form for Udyog Aadhar. Without filing this you cannot obtain a Udyog Aadhar. A simple registration form containing a 12-digit number for future reference. After the successful submission of your memorandum, you will get your 12-digit Udyog Aadhar number.

Personal Details under Udyog Aadhaar Memorandum:

- Name of Entrepreneur

- Address

- Email ID

- Phone number

- Aadhar card Number

- PAN number

- Gender

- Social category

- Others

Professional Details:

- Place of Business

- Type of Business

- PAN number of Business

- Location of Plant & Machinery

- Date of Commencement of Business

- Incorporation Certificate Number

- Person Employed

- Bank Details

- National Industry Classification code

- Other Details

MSME Certificate Download

MSME Certificate is also known as Udyam/MSME/Udyog Aadhaar Certificate and can be easily downloaded online.

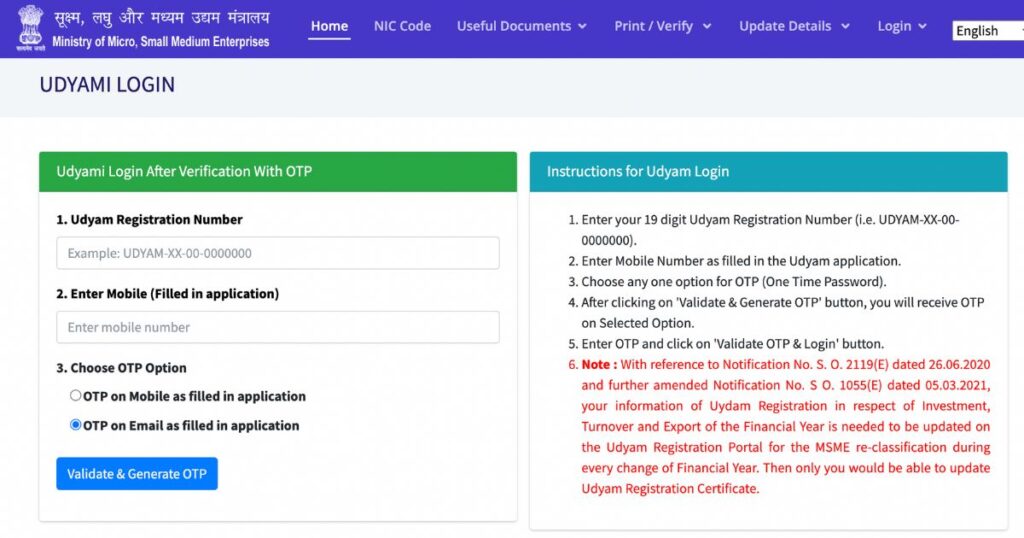

STEP 1: Go to the Udyam portal through http://udyamregistration.gov.in

STEP 2: On the Top Right Corner out of all Options select Option “Print/Verify”

STEP 3: Select Sub Option “Print Udyam Certificate” out of all sub-options in the Print/Verify Option

STEP 4: Enter the following required details on the “Udyami Login with OTP” Option. I. Enter your 16-digit registered Udyam Registration Number into input box 1 in the format “UDYAM-XX-00-0000000” II. Enter your 10 digit Mobile Number into input box 2, mobile number as filled in Udyam Aadhaar application data

STEP 5: For “Validate & Generate OTP” Choose either OTP on Mobile as filled in application or OTP on Email as filled in application

STEP 6: Enter OTP received on the selected Mobile Number or Email and then click on the “Validate OTP & Print” Option

STEP 7: View Udyog Aadhaar Certificate Data on Home Screen

STEP 8: For getting Certificate Copy you can select either Print or Print with Annexure Option available at the Top-Center. Print Option – Only MSME Certificate will be available Print with Annexure Option – MSME Certificate with UAM Application (Udyam Aadhaar Memorandum Application) will be available.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio can Help?

To make your dreams come true of having a business of your own and managing it nicely, Lio App can help you big time. The app lets you keep all sorts of data together in a more organized manner. You can keep records, and create tables and lists while working solo or with a team.

The many features of Lio would help you with your retail business as you would be able to maintain all data on a track that you can use at any time. If you want to upload a document, then you can do that. Know the money transactions, cash inflow, profit and loss you are making, Udhaar, list of products, services, and even the teammates and clients that you have all in one place.

Your retail business ideas will certainly become successful businesses if you go on this journey of managing your business with Lio.

Step 1: Select the Language you want to work on. Lio on Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Hope by now you have understood everything that you wanted and needed to know about udyog aadhar. This is important for all enterprises and without this it would not be right to start a company. Hence read and understand everything about it to know in and out about it.

Frequently Asked Questions(FAQs)

Who is eligible for Udyog Aadhar?

All the small, medium, and micro enterprises belonging to the manufacturing or servicing sector are eligible for registration under Udyog Aadhaar.

What is Udyog Aadhar fees?

There is no fee applicable for filing the Udyog Aadhaar Memorandum.

Is Udyog Aadhar and MSME Registration same?

Both MSME and Udyog Aadhar registration processes are quite similar but they are different initiatives.

Is GST required for Udyog Aadhar?

Having PAN & GST number is mandatory.

Can one open bank account with Udyog Aadhar?

The Udyog Aadhar can be used to get current Bank Account.

Is there any turnover limit for MSME?

1 Crore of investment and Rs. 5 Crore of turnover. The limit of small unit was increased to Rs. 10 Crore of investment and Rs 50 Crore of turnover.