Types of GST in India – IGST, SGST, CGST & UTGST Explained

After getting approval from Lok sabha in 2017 and Rajya sabha early in 2017, this unified tax was brought into effect from 1st July 2017.

GST is divided into various categories to ensure the smooth functioning of the taxing system and make it less complicated for the different government levels to manage their finances through taxation and plan the expenditure accordingly.

The types of GST are SGST, CGST, IGST, and UTGST. More about them, below

Aim Of GST

GST was designed with various aims in mind after years of study and analysis. Following are the objectives of the implementation of a new tax system in India-

- One nation, One tax- The unified tax system ensures that there are no different taxes for different things in different places. GST means each state has the same tax rate for the same commodities. It also simplifies the tax filing process as the taxpayers do not need to keep track of different taxes and their deadlines. Instead, they can just file their indirect taxes in one go.

- The subsumption of most of the indirect taxes- GST includes most of the indirect taxes which are applied on the producers at various stages of production such as value-added tax and excise duty. The states and the central government had different taxes as well. With the introduction of GST, all of it has been subsumed and there is only one tax with different sub-categories.

- Prevent tax evasion- Since the GST is supervised and cross-checked by the centralized surveillance system and e-invoices, tax fraud can be caught easily and tax evasion can be prevented more effectively. It also helps in identifying the defaulters and taking relevant action to get the correct amount of tax as enlisted.

- Increase taxpayers- Earlier, different taxes had different limits on registrations but since GST is applied on both goods and services, it has widened the extent of registered vendors and helps in the standardization of unorganized sectors within the taxing system.

- Ease of business- Since the filing of GST is done online, it has made the process much easier. Businesses do not have to keep track of different taxes and their deadlines. They can just file one tax at the same time from the comfort of their home online and be free of worry.

- Better logistical process- The introduction of GST has removed the need for documentation at every step of the manufacturing process and made the keeping of records easier since it is online. This results in faster production and transportation of goods and services across the country. It reduces the time products spend in warehouses and e-way bill helps in faster transportation of the goods. This has improved the logistics and made the production process far more efficient.

GST has fitted over thousands of goods and services under 4 different tax slabs which are as follows- 5%, 12%, 18%, and 28% under GST.

The tax on gold and other precious or semi-precious stones is assigned a 3% and 0.25% special rate.

There exists a cess on luxurious commodities and demerit goods like tobacco, aerated drinks, and the like.

But few commodities do not fall under the jurisdiction of GST. These commodities that fall under the Form C section of the taxing system are the petroleum crude and high-speed diesel as well as motor spirit and natural gas.

The aviation turbine fuel does not fall under the control of GST either. The alcoholic liquor for human consumption is taxed in a different manner by different states and does not follow the GST system.

GST is then applied only on transactions about resale, use in manufacturing or processing processes, or used in specific sectors like mining, electrical energy generation, and distribution, and the telecom network.

Since GST had to subsume a huge number of different indirect taxes, integration of all of them within a single indirect tax system posed various challenges to the committee.

Therefore, it was decided to categorize GST rates into categories known as IGST, CGST, SGST, and UTGST. Since GST is being managed by the central government, it will give greater control to them for taxes.

To avoid the misuse of power and to ensure the state levied taxes are easy to receive by the state and central government respectively, this setup was made. There is a similar structure in the constitution of India which categorizes the subjects the different governments need to deal with.

There we have three lists known as union list, state list, and concurrent list.

The union list has the subjects of national importance and all the decisions on these matters are made by the central government such as defence, currency, and so on.

In the state list, there are topics that are better left with the state government for efficient working of the bureaucracy. These are matters of varied importance such as agriculture, police, and so on.

The state government has better information regarding these matters within their region and therefore, it is considered more efficient if they make the decision.

The third and final list is known as the concurrent list and it includes matters of combined concern.

In this case, both centre and state work together to reach a consensus. However, in case of any dispute, the central government holds superiority.

Types Of GST

To ensure the smooth functioning of the taxing system and make it less complicated for the different government levels to manage their finances through taxation and plan the expenditure accordingly.

IGST- Integrated Goods and Services Tax

The Integrated Goods and Services Tax or IGST is the tax type for the goods and services which are interstate.

This includes import and export and interstate commodities. It is regulated by the IGST Act and the supply of goods and services of interstate nature is considered to fall in this category.

The interstate good implies that the manufacturing and the selling of the goods or services are taking place in different states of India.

In such cases, the central government receives IGST and it is then divided between the involved state governments accordingly.

Example- A seller from Kerala made a deal with a customer in Uttarakhand in online mode. The cost of the commodity is 5000.

So the customer will purchase it for 5900 if the commodity falls under the 18% GST slab then the IGST of 900 will be added to the cost. This amount of tax will be received by the central government.

SGST- State Goods and Services Tax

The State Goods and Services Tax or SGST is applied to those goods or services whose transactions take place within a single state.

This type of commodity will be taxed twice. Once, it is calculated for SGST and the second tax will be CGST. In such a case, the taxes will be received by state and central respectively.

It is not collected by only one government and divided later as in the case of integrated goods and services tax.

It is regulated by the SGST Act and all the taxes received in this type of GST is received solely by the government of the state where the transaction is taking place.

Example- The seller is selling a commodity whose cost is 5000 rupees. If the commodity falls in the 18% tax slab then the SGST will be 9% and the remaining 9% will go to CGST.

The total tax from the cost will be 900. The state will receive 450 and the central government will receive 450 rupees respectively on the sale of this commodity.

Therefore, when this commodity is sold to a customer in the same state, the customer will be paying 5900 rupees and the tax earned from the sale will be divided equally between the state and central governments through SGST and CGST.

CGST – Central Goods and Services Tax

Exactly like the SGST, this CGST is levied on goods and services exchanged within the same state. This type of commodity will be taxed twice as mentioned previously.

Once, it is calculated for SGST and the second tax will be CGST. in such a case, the taxes will be received by state and central respectively. It is not collected by only one government and divided later as in the case of integrated goods and services tax.

It is regulated by the CGST Act and all the taxes received in this type of GST is received solely by the central government.

The center will get its tax share without complicating the process by including the tax received by the state.

Example- The seller is selling a commodity whose cost is 5000 rupees. If the commodity falls in the 18% tax slab then the SGST will be 9% and the remaining 9% will go to CGST.

The total tax from the cost will be 900. The state will receive 450 and the central government will receive 450 rupees respectively on the sale of this commodity.

Therefore, when this commodity is sold to a customer in the same state, the customer will be paying 5900 rupees and the tax earned from the sale will be divided equally between the state and central governments through SGST and CGST.

UTGST- Union Territory Goods and Services Tax

The Union Territory Goods and Services Tax or UTGST is levied on the transaction of goods and services within the union territories such as Andaman and Nicobar Islands, Chandigarh, Daman Diu, Dadra, Nagar Haveli, and Lakshadweep.it is regulated by the UTGST Act.

The tax collected from the UGST is received by the government of union territory. It works exactly like the state GST. The commodity is taxed by UTGST and CGST when sold and the taxes are received by the respective authorities.

Example – The seller is selling a commodity whose cost is 5000 rupees. If the commodity falls in the 18% tax slab then the UTGST will be 9% and the remaining 9% will go to CGST. The total tax from the cost will be 900.

The union territory government will receive 450 and the central government will receive 450 rupees respectively on the sale of this commodity.

Therefore, when this commodity is sold to a customer in the same union territory, the customer will be paying 5900 rupees and the tax earned from the sale will be divided equally between the government of union territory and central governments through UTGST and CGST.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Can Lio Help?

Lio is a small and medium-sized business (SMB) all-in-one management solution. Using Lio you can simplify accounting and inventory management, as well as banking, taxation, and payroll, so you can focus on growing your business.

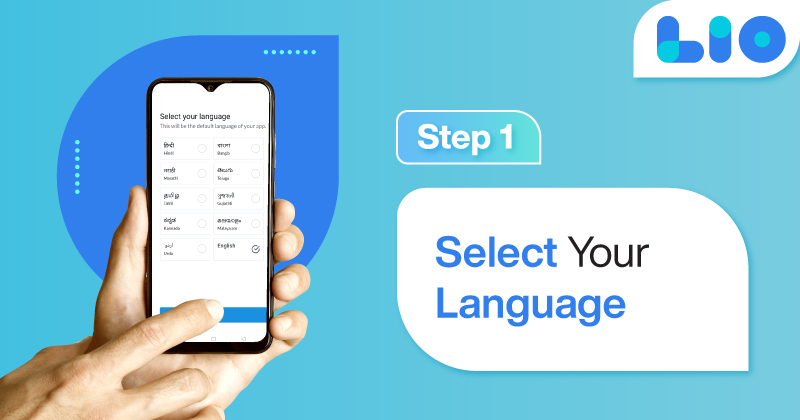

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

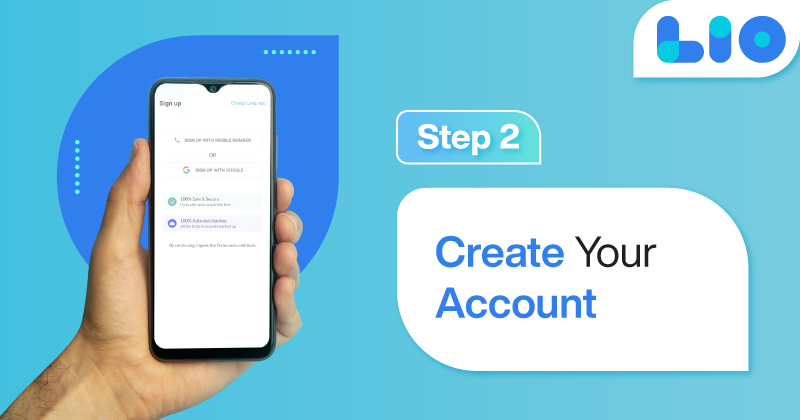

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

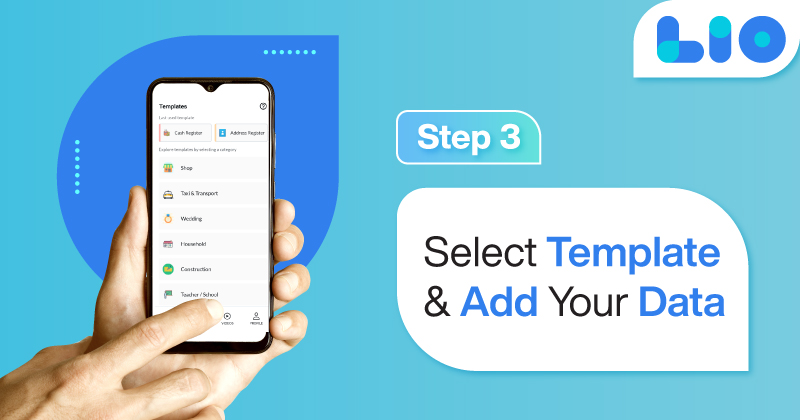

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

The introduction of GST has benefited people as well as the government in various ways. Also, systematic organization of taxes is performed so that the government can run the country in a very smooth way. In this detailed account by me on GST and its types, hopefully, you have understood it and can now differentiate between them all.

Frequently Asked Questions(FAQs)

What is the difference between direct tax and indirect tax?

The direct tax is that which a person pays from their pocket. The indirect tax is that which is paid to the government by the enterprises or individuals collected from the customer.

When was the GST act passed?

The goods and services act was passed in Parliament in March of 2017 and was brought into effect from 1st July 2017.

WHAT ARE THE AIMS OF GST?

The subsumption of most of the indirect taxes

– One nation, one tax

– A better logistical process

– Ease of business

– Prevent tax evasion

– Increase taxpayers

10 Comments

Many thanks for your informative posts. You’ve done an excellent job of explaining the many types of GST in India.

Hello Ankit,

Thank you so much for your warm words.

I’m delighted this article was insightful for you.

Have fun reading!

Please explain the meaning of a bank reconciliation statement in a nutshell.

Hello Mallika,

A bank reconciliation statement compares an entity’s bank account with its financial records by providing a summary of banking and business activity. The statement lists all transactions involving a bank account for a given time period, including deposits, withdrawals, and other activity.

I’ve been trying for a few days to download an e-invoice from the GST portal, but something isn’t working; could you help tell me how?

Hello Kajal,

Step 1: Access the GST website.

Step 2: Click “Services,” then “Returns,” and finally “Returns Dashboard.”

Step 3: Choose the appropriate time frame and choose “Details of Outward Supplies of Goods or Services GSTR 1”.

Step 4: Select “Download details from e-Invoice.”

I hope that was clear.

I have a simple question.. What type of tax—direct or indirect—does sales tax fall under? Thanks..

Hello Vihayas,

Sales tax is an example of an indirect tax.

Excise duty, VAT, service tax, entertainment tax, custom duty, etc. are more examples of indirect taxes.

Can you please tell me which tax is levied by the central government but collected by the state government? Thank you in advance. My understanding on a variety of topics is growing greatly thanks to your articles.

Hello Roshina,

Stamp duties listed in the Union List are to be imposed by the Government of India, but collected and appropriated by the States, as stated in article 268 of the Indian Constitution.