Here’s all to know about The Different types of accounts in accounting

Starting a new business comes with a new obligation of bookkeeping. There are many types of accounts you can adopt as a business owner to maintain error-free books. But what are they? What are the different types of accounts in accounting?

As a business owner, you must be all too aware of debits and credits and their functions in maintaining journals. It is pretty simple to understand.

The rather tricky part arrives when you study the types of accounts they affect. Nothing to worry about, below we have explained the types of accounts in accounting as well as their roles in an enterprise.

What is an Account?

An account is a complete description of the transactions that take place in a certain organization in relation to a specific person, corporation, or their agents or objects. Whenever a company undertakes transactions, it must label and identify the accounts involved.

They adhere to the relevant accounting standards and tabulate such transactions using the golden rules of accounting.

The most common format used to create accounts is the T-format, which records the debits on the left column and credits on the right side.

What are the Types of Accounts in Accounting?

There are 3 different types of accounts in the double-entry accounting method that let you create a blunder-proof log of your journal entries.

The Golden Rule of Accounting is a principle that the different types of accounts use to differentiate their debit and credit aspects. The following are the types of accounts in accounting:

Personal Account

A personal account is a general ledger account that is associated with all persons or people, such as individuals, businesses, or organizations.

These people might be natural people, artificial persons, or representatives, depending on the situation. For example, customers, vendors, salary accounts of employees, etc.

The golden rule for Personal Account: Debit the receiver, credit the giver.

Types of Personal Account

Natural Persons

As the name suggests, natural persons account record transactions with real people, like ‘John’s A/c’.

Artificial Accounts

Artificial Accounts record transactions between the organization and artificial persons like companies and institutions.

Representative Accounts

Representative accounts are accounts that represent a certain purpose of work.

Real Account

Real accounts are ledger accounts that record transactions relating to a company’s assets and liabilities.

This category of accounts includes both tangible and intangible accounts. Unless an asset is sold or a payment is made for liability, or the organization is closed or acquired, these account balances do not reach zero at the conclusion of the financial year.

These accounts are included on the Balance Sheet, and their balances are carried over to the next fiscal year.

Golden Rule for Real Account: debit what comes in and credit what goes out.

Types of Real Account

Tangible Real Account

Accounts that are physical in the form are referred to as tangible real accounts. To put it another way, these assets are perceptible. These assets can be felt, seen, and touched. For example, a building.

Intangible Real Account

Accounts that deal with non-physical assets or belongings are referred to as this kind of account. These assets cannot be seen, felt, or touched, yet they may be valued in monetary terms. These assets can be said to have some value associated with them. For example, patent, goodwill, etc.

Nominal Account

This type of account records transactions including income, expenditure, profit, and loss. Although these elements do not appear in any physical form, they do exist.

For example, only two aspects, money and stock, are immediately influenced during the purchase and sale of items.

Apart from that, we may gain a profit or a loss from such operations, and we may incur certain expenses in order to prompt them to take place.

The Nominal Category encompasses these secondary aspects, as well as the accounts that appear on the Profit and Loss Statement.

Golden Rule for Nominal Account: Debit all expenses and losses and credit all income and gains.

Other Types of Accounts in Accounting

Apart from the ones mentioned above, there are five other types of accounts in accounting. They have been described below.

Cash Account

The simplest approach to keep track of cash payments, deposits, and withdrawals is to use a cash account. It is used to record cash income and expenditure in the ‘Terms or Payments Accounts’.

Income Account

Income accounts are meant to document the stream of income, allowing an entrepreneur to identify where their revenue comes from.

Expense Account

These sorts of accounts keep track of all of the company’s expenses.

Liabilities

This kind of account is used to manage any sort of debt or loan that falls under liabilities.

Equities

If the account owner makes any kind of investment, such as common stock purchases or retained earnings, the entries will be classified as equities.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How can Lio help?

Lio may be used to manage all of an organization’s data like income and expenses in one spot thanks to its multiple templates like the expense report template. It lowers the expenses of document printing and distribution while also storing critical data in a secure and protected manner.

Calculating erroneous totals or neglecting to report data on time may lead to a disaster in the corporate world, which is where applications like Lio come in handy. Lio assists in financial transparency audits by avoiding costly and frequent human errors.

It can assist a business owner and management in determining where to cut costs and where to spend more. Data that is properly tabulated can aid in the development of smart plans and wise allocation of resources to the proper channel.

Lio offers a holistic suite of digital services that makes even the most difficult day-to-day operations of businesses appear easier while also collecting, organizing, and analyzing their data.

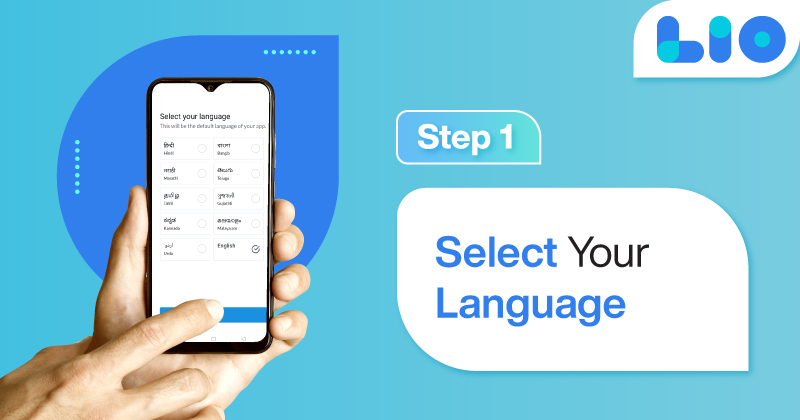

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

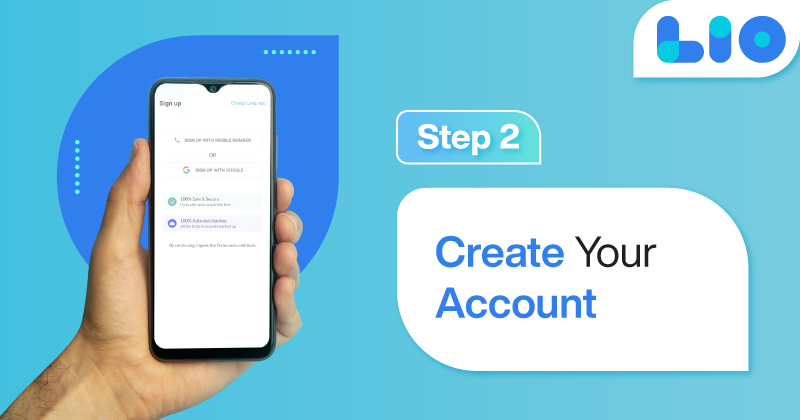

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

A corporation’s transactions must be accounted for. To record these transactions, the organization must prepare journal entries, which are subsequently summed up in ledgers. The journal entries are approved based on the accounting’s Golden Rules.

To apply these rules, one needs to determine the kind of account first. Accounting is built on these foundations.

They are critical for proper data tabulation; if one does not understand the golden rules, he will be unable to produce journal entries and so will be unable to account for transactions precisely.

I hope by now you have understood the different types of accounts in accounting and have all your doubts cleared and questions answered.

Frequently Asked Questions(FAQs)

How do debits and credits work?

When transactions are made, you adjust accounts by increasing one and decreasing another in your records to reflect the new changes. The goal of “debiting” and “crediting” accounts is to raise one account’s values and decrease the other’s.

What kind of account is a general ledger account?

A general ledger account that is linked to liabilities and assets is known as a real account.

What would be an example of a Nominal Account?

An Interest Account is an example of a Nominal Account.

What is the golden rule when it comes to Personal accounts?

The golden rule is that the giver gets credited and the receiver is debited.

What do tangible real accounts about?

Tangible Real Accounts are concerned with actual physical things that can be seen and touched.

6 Comments

The phrase “retained earnings” has come up frequently. Please provide a short outline of what it means.

Hi Tejas,

thankyou for the question.

Retained earnings are the cumulative profits that remain after a company pays dividends to its shareholders.

In simple words, Retained earnings are the profits that a business has earned minus any stock dividends or other distributions.

Please provide me with a few examples of equity investments.

Hello Lilly,

An equity investment comes with a number of advantages for the investor, including risk distribution, simple transfer, profitability, and simple monitoring. Equity investments include things like preferred shares, retained earnings, equity mutual funds, stocks, and private equity investments.

Please enlighten me about accounts receivable balance.

Hello Dylan,

The amount of money owed to a business for delivered or used but unpaid goods or services is known as accounts receivable (AR). The balance sheet classifies accounts receivable as a current asset. Any money owing by clients for purchases done using credit is known as AR.