Preparing Profit and Loss Statements for SMBs: A Definitive Guide

“Profit is not something to add on at the end, it’s something to plan for at the beginning”

Let’s start with a very simple example. Imagine there are two businesses – A and B. In the month of March, A generated revenues worth ₹100,000, while B generated ₹75,000.

From this, you will assume that A is doing a much better job than B monetarily. But this need not always be true. What if A spent ₹50,000 on Rent while B spent only ₹10,000? Doesn’t this turn the tables now?

Profit and Loss Statements

What is a Profit and Loss Statement?

A Profit and Loss (P&L) statement details the income and expenses of a business over a defined period. It is also referred to as an income statement, statement of profit, statement of operations, and a profit and loss report.

Regardless of the term used, a P&L statement is basically a snapshot of how good or bad a business is performing. This statement can be generated at infrequent intervals viz. monthly, quarterly, or even yearly, depending on the requirements of a business.

What Is the Formula for Profit and Loss?

A profit/loss is the monetary value that is calculated by adding the total revenue and subtracting it from the total expenses. If the figure is positive, it is considered as ‘profit’. And, if the figure is negative, it is time for you to buckle up your shoes and start running to convert your loss into profit.

How to create a Profit and Loss Statement?

Different companies have different types of profit and loss statements. However, most of them include the below sections by default –

- Revenue

- Cost of goods sold

- Expenses

- Net Profit

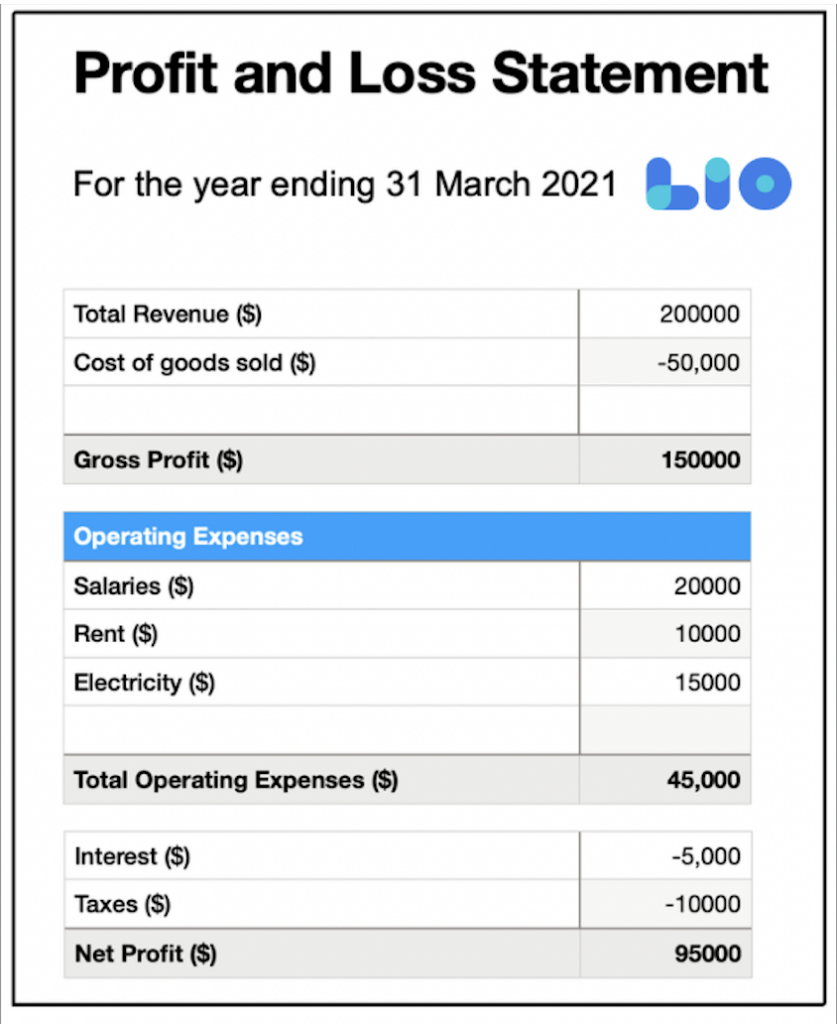

Here is a sample profit and loss statement-

And here are the different steps to build a profit and loss statement –

Step 1: Calculate the Revenue

This is your business’ total sales and income. While calculating revenue, make sure to add all sources of business income. The total revenue is the total sales of goods and services irrespective of the revenue source: sales, marketing, investment, or customer success.

Step 2: Calculate the Cost of Goods Sold (COGS)

This is essentially the cost of inventory or materials used to create your products or services. A simple formula to calculate COGS is –

Cost of goods sold = Beginning inventory + Purchases – Ending inventory

You need to add all the expenses associated with selling the goods. This includes both fixed costs such as advertising costs, salary, employee benefits, office supplies, etc. The variable costs include shipping costs, sales commission, and so on.

Step 3: Compute the Gross Profit/Loss

Now subtract the cost of goods sold from the revenue to arrive at the Gross profit or Loss.

Gross profit/Loss = Revenue- Cost of Goods Sold

Step 4: Calculate the total operating expenses

Operating expenses are those expenses that your business incurs on a daily basis. This includes Rent, Utilities, Salaries, Advertising Costs, Payments to Vendors/Contractors, Professional fees for accountants, etc.

The Non-Operating expenses will include the less frequent costs that impact the bottom line. This will include interest on loans and taxes.

Step 5: Compute the Net Profit/Loss

Subtract the operating expenses from the Gross profit to arrive at the Net Profit.

Net profit = Gross profit – Expenses

Net Profit is the amount that represents the increase (when profits are positive) or decreases (when losses occur) in the business’s net worth at the end of the business accounting period.

How does a P&L statement help your business?

A profit and loss statement provides essential data that is key to making decisions about your business. As an owner, you can see what parts of your business generate the most revenue or find areas that are overrun with extra expenses.

For instance, the P&L report indicates exceptionally high supplier costs for a key ingredient, indicating it’s time to find a new supplier.

Businesses can also use the information in the P&L statement to decide if their growth strategy is working or if it needs to be tweaked (or scrapped).

While incurring a loss isn’t the end of the world, P&L statements point out issues in business operations. It lets you know where your business needs to adjust and make amendments. If your gross profit is low, it’s time to boost sales or increase the price of your products/services.

Similarly, a detailed P&L statement can be prepared for an entire fiscal year, which is used by the owner to compile the income and expenses for the business’s tax return. They also assist in budget preparations and for calculating the working capital requirements of the business.

Lastly, these statements come in handy when applying for a business loan. Companies will often have to produce several years of profit and loss history, if available to the bank while seeking a loan.

Similarly, when a company is attracting investors, or a business owner wants to sell, interested parties will want to see the P&Ls for multiple years to gauge the direction in which the business is moving.

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

How to use the Lio app to create a P&L Statement?

- In your Lio App, navigate to small businesses

- Select Profit and Loss Account Register Template

- To add an income, change the Transaction Type field to ‘Payment received’

- Input all your business expenses by changing the Transaction Type field to different Payments made such as ‘Payment towards Invoice/Bill’ or ‘Salary Payment’.

- Your net profit will be determined by the value Balance Amount

When the balance amount is positive, your business is profitable and in case it’s negative, you’re operating at a loss.

Conclusion

This post would have shown you that profit and loss management is not just about measuring how much you make—it also means how much you have in hand.

When you chart your profit and loss correctly, you can identify gaps in your expenses and savings, defusing financial problems before they become major losses.

6 Comments

I have used your Lio app for maintaining my expenses and other transactions. It’s an amazing app, the profit and loss register is very helpful.

Hello Hemant,

Thank you for the generous words.

So pleased to hear that you liked Lio. Do explore all the templates as Lio has 60+ templates with 20+ categories covering all your business needs, you can add images and can also customize the empty template according to your needs and requirements.

This article is very educational and was a fantastic read! Many thanks for sharing.

Hello Anju,

I really appreciate your warm sentiments.

I’m delighted you found this article intriguing.

When I launch my firm, at what point should I truly begin measuring profit and loss? Please provide a short outline.

Hello Priya,

You must compute profit and loss from the very beginning.

By employing profit and loss templates, you can apply a systematic approach. The profit and loss statement shows how profitable your company can be.