Learn All About Credit Sales Journal Entry

All business owners know that it is a difficult task to keep track of all credit entries but it is also very important to do so. But recording a credit sales journal entry can be done in simple steps. Let us learn how.

What is a Sales Credit Journal Entry?

Credit sales journal entry refers to the journal entry which is recorded by the company in its sales journal when the company makes any sale of the inventory to a third party on credit. In this case, the debtor’s account or account receivable account is debited with the corresponding credit to the sales account.

In simple words, it is a type of accounting entry that is used to record sales of merchandise on credit.

How to Record Entry of Sales Credit?

Whenever goods are sold on credit to a buyer, the account receivable account is debited which increases the company’s assets as the amount is receivable from the third party. The corresponding credit will be in the sales account, increasing the company’s revenue. The entry to record the sales on credit is as follows:

| Particulars | Dr ($) | Cr ($) |

| Account Receivables A/C …..Dr | XXX | |

| To Sales A/C | XXX |

When the company receives cash from the buyer for the goods sold on credit. The cash account will then be put in credit.

The entry to record the receipt against the sales on credit is as follows:

| Particulars | Dr ($) | Cr ($) |

| Cash A/C …..Dr | XXX | |

| To Accounts Receivable A/C | XXX |

Accounting and Journal Entry for Credit Sales

In the case of credit sales, the respective “debtor’s account” is debited, whereas the “sales account” is credited with an equal amount.

| Debtor’s Account | Debit |

| To Sales Account | Credit |

Golden rules of accounting applied (UK)

- Debtor’s A/C (Type – Personal) > Rule – Dr. the Receiver

- Sales A/C (Type – Nominal) > Rule – Cr. all Incomes and Gains

Modern rules of accounting applied (US)

- Debtor’s A/C (Type – Asset) > Rule – Dr. the Increase in Assets

- Sales A/C (Type – Revenue) > Rule – Cr. the Increase in Revenue

Example of Sales Credit Journal Entry

Let us look at some examples to understand it better.

Example #1

Apple Inc is a laptop and computer dealer, and it sold goods to Kevin Electronics on January 1, 2018, worth $50,000 on credit. Its credit period is 15 days. It means John Electronics must make the payment on or before January 30, 2018.

Below are the journal entries in the books of Apple Inc:

At the time of the sale of the laptop & Computer:

At the time of Receipt of Payment:

Example #2

Apple Inc gives early payment discounts or cash discounts. In the above example, Apple Inc is offering a 10% discount if John Electronics makes the payment on or before January 10, 2018. Accordingly, Kevin Electronics made the payment on January 10, 2018.

Below are the journal entries in the books of Apple Inc:

Example #3

The above example tells us that John Electronics could not make payment by January 30, 2018, as it went bankrupt. And as per Apple Inc, the outstanding debt is unrecoverable and is a bad debt now.

Below are the journal entries in the books of Apple Inc:

John Electronics will pass access for the bad debt at the end of the financial year.

Example #4

ABC Inc sold goods worth $1,000 to XYZ Inc on January 1, 2019, on which a 10% tax is applicable. XYZ Inc will make payment in two equal installments.

Below entries will be passed in the books of ABC Inc:

At the time of credit sales:

We have assumed the basic value of goods is $1,000 hence have charged a 10% of tax on that value, which ABC Inc will collect from XYZ Inc and pay to the government. ABC Inc can take input credit of the same amount and claim a refund from the government.

At the time of receiving 1 Payment:

How to show Credit Sales in Financial Statements?

Let’s understand how to show all the above entries in financial statements

Credit Sales: Whether cash or credit, any sales will come in profit & loss a/c under the income side with the sale value of goods.

Debtors: These are current assets and fall under the assets side of the balance sheet under existing assets.

Discount: Any discount given to the dealer comes under the expenditure side of the profit & loss account, decreasing the company’s profitability.

Bank Balance: Also a current asset and will show under the assets side of the balance sheet under existing assets. On the receipt of customer payment, the bank amount will increase, whereas debtors will decrease. Thus, the total balance of current assets will not remain the same.

Advantages of Credit sales Journal Entry

Some of the advantages of credit sales journal entry are as follows:

- They help in recording the transaction involving the sale of goods on credit by the company appropriately, keeping track of every credit sale involved.

- With this, the company can check the balance due to its customer on any date.

- It also helps the company track the balance outstanding of the customer in case the customer approaches again for credit sales

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Can Lio Help

No matter what you are planning to do or what business you decide to run, Lio can be of big help to anyone and everyone. With the use of this application, you can make your daily tasks on track and keep tabs on all things.

Lio helps in getting your life organized and it is that one place where you can store all your data regardless of what it is.

Suppose you are planning to run a business. In that case, you can have a dedicated place to jot down all the important things, information, contacts, ideas, licenses that you need to acquire, employee details, customer details, deadlines, and everything else. Having Lio in your life would definitely make your life much easier and hassle-free.

Click this blue button below. Stop thinking and start working on your business, grow with Lio.

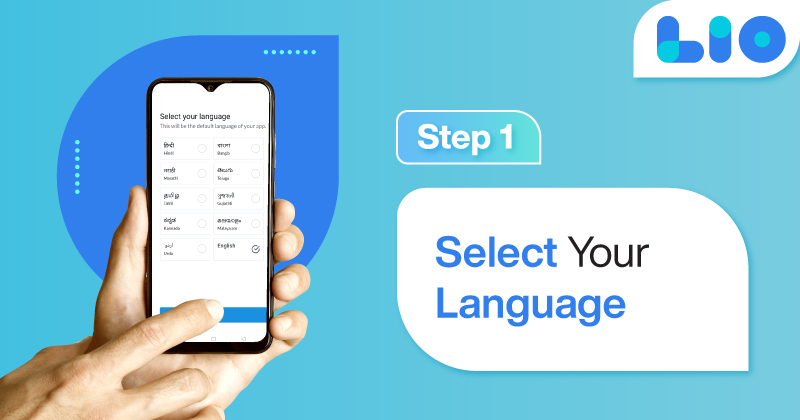

Step 1: Select the Language you want to work on | Lio for Android

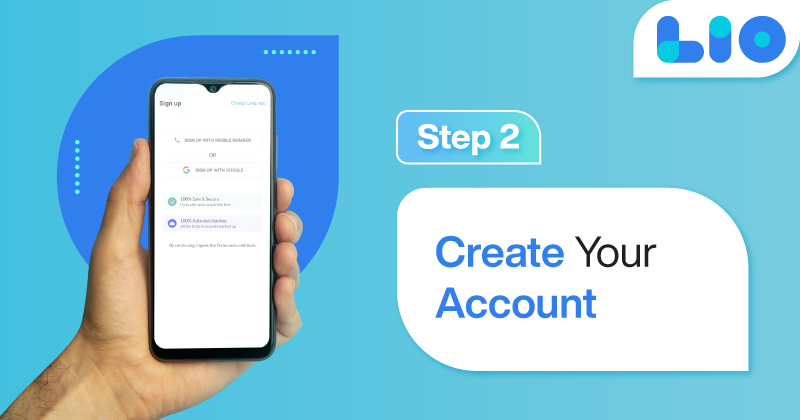

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template to which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Sales credit journal entry is an important part of any company that sells its goods on credit. At the time of sales on credit, accounts receivable accounts will be debited, which will be shown in the balance sheet of the company as an asset.

This is unless the amount is received against such sales, and the sales account will be credited, which will be shown as revenue in the income statement of the company.

It helps record the transaction involving the sale of goods on credit by the company appropriately, keeping track of every credit sale involved.

Frequently Asked Questions (FAQs)

Is revenue the same as credit sales?

Net credit sales do not include cash sales. Additionally, net credit sales include sales returns and sales allowances.

Is credit sales recorded in a sales journal?

The sales journal records all credit transactions involving the firm’s products.

How do you record credit sales?

The credit sale is reported on the balance sheet as an increase in accounts receivable, with a decrease in inventory.

Is a credit sale debit or credit?

Sales are recorded as a credit because the offsetting side of the journal entry is a debit

Are credit sales recorded in a journal?

A sales journal entry records a cash or credit sale to a customer.