Here’s All About Inventory Costing

Do you want to know in detail about inventory costing? If yes, then we will definitely help you know more about inventory costing.

Introduction

Inventory in simple terms means goods that can either be complete or incomplete, for one’s own use to run their business and for sale. The three elements of inventory are:

- Raw materials: the entire production process is dependent on the raw materials

- Incomplete goods: the work-in-progress products in the process of production

- Finished goods: finally the finished products after going through the prior processes the final product for sale or the business entity’s own purposes of consumption.

The final product or the finished product is considered to be the asset of any enterprise and is presumed to be converted into currency in time when needed.

Inventory costing in other words is related to the method of allocating a monetary value to the inventory that the enterprise controls at any point in time. While inventory carrying costs are the costs in relation to the maintenance and storage of the inventory in a given period of time.

Another definition for inventory carrying cost can be the annual percentage of the inventory value i.e. the annual average inventory. Annual average inventory in terms of retailers. Inventory carrying costs value is always quite high although it differs vastly depending on the type of the business and the scale of the business. Costs caused by the processing and movement of inventory are directly related to the flow of the inventory. A static inventory focuses on the costs incurred by the enterprise when owning the inventory.

It is assumed that inventory carrying cost by itself represents an average of 25% of the inventory value of the products in hand.

Inventory costing as you now know is the general technique of assigning value to the product or the inventory and even though all inventory costings involve assigning a certain value to the products sold out, there are a few different kinds of methods of costing such as the LIFO, FIFO, etc. Every business has to select from one of the different costing methods which the company bases on the specifics of the requirements of the inventory. We will discuss these methods of inventory costs in detail in this article.

It is difficult to come up with a clear definition of inventory value. The terms related to inventory costs such as total cost of ownership of inventory, total inventory cost, or TIC, etc can in themselves be complicated in nature and difficult to comprehend.

For any eCommerce website, retailer, or wholesaler, inventory cost is theirs as the greatest expanse product as well as the greatest asset. Not assessing the inventory cost in a systematic manner therefore may have its own repercussions on the aspect of the management of the company as well as in regard to the financial aspects of the enterprise.

All About Inventory Costing

Inventory cost helps the company determine how prices can be reduced, and where and how to make changes. Calculates the profit to be gained by the company, how should capital be assigned to various products, and what items or suppliers should be selected.

Significance

Inventory costing affects the overall cost of goods i.e. COGs, which means inventory costing and cost of goods are directly proportional to each other. Therefore assessing inventory costing in a proper manner is crucial for any business.

This will then reflect on the gross profit of the product and finally will affect the taxable income. Inventory costing as a result is essential indirectly affecting all the essential financial statements and also the balance sheet.

Contrasting inventory costing methods can result in contrasting values of inventory in the final process. If there is a method that allocates a higher value to inventory then the cost of the products sold will plummet.

This, as a result, will cause an upswing in the gross profit and therefore the income that is taxable will go up. On the contrary, if a gross profit will go up, and hence, taxable income will also go up. On the other hand, if a technique allocates a lower worth to the inventory, the cost of products sold will upscale. The gross profit will fall in scale, and the income taxable, as a result, will also plummet.

Categorization

There are many factors on the common grounds that result in the overlapping or the wavering of the categories and the subcategories of inventory Inventory costs are divided and subdivided into categories that are usually and majorly used for the proper management of inventory costs.

Inventory costs fall under 3 major categories:

- Ordering Costs – Also known as setup costs in reference to producers, is the cost of restoration of the inventory. It looks into the resistance created by the orders (costs incurred every time a customer places an order) and covers them efficiently that is, the costs incurred every time you place an order. These costs can be divided into two parts:

- Cost of the ordering process alone

- Cost of the inbound logistics

- Carrying Costs – For the smooth working of the static inventory, the carrying cost plays a central and crucial role i.e. when concentrating on the factor of whether the enterprise possesses more inventory and vice versa independent of the process of the flow of the inventory.

Carrying cost is also subdivided into several categories which are as follows:

- Cost of inventory services

- Cost of inventory risk

- Cost of storage space

- Cost of capital costs/ financing charges

- Stock out costs: Stock out costs or shortage costs will give you the final and complete vision of the inventory costs. Stockout cost is the cost sustained when stockouts take place. In the case of retailers, it encompasses the change of suppliers to fast deliveries, transition to less profitable products, costs of emergency shipments, etc. although this type of cost is very easy to determine accurately, other kinds of costs are difficult to get precisely determined, for example, the universal reputation of the company or the cost in case of loss of loyalty or customers.

Creating a model of the cost of stockouts is a vast method in itself that cannot be written down precisely in short. To simplify this, you can consider that there is a relationship of balance between the opportunity price of the stock-outs and the cost of the inventory in hand in other words.

Linking the levels of service results in achieving the balance in terms of cost inventory with that of the price of typically the stock-outs.

Problems Faced when Assessing Inventory Costs

If you look at it carefully you will witness a lot of companies facing difficulties in terms of proper assessment of inventory costs. Many companies rely on the false assumptions that the regular form of everyday accounting provides us with a reasonable estimation of the costs incurred from the calculation of the company’s inventory cost.

Measurement of the inventory cost by itself is a difficult problem to solve. A number of different cost accounting systems are prevalent today and can be applied but they can also be inadequate or problematic in terms of the others.

It is also always not possible and feasible to keep track of all the costs or to split and assign them consistently in a proper manner. When you have started to assess the inventory cost you need to take into consideration the fact that relevant numbers will not appear when a conventional accounting system of records is utilized.

Then, it is neither always possible nor economical to keep track of all costs incurred. When assessing inventory cost you have to be cautious about the set of assumptions and rules and regulations used to produce the numbers.

Elements to be calculated should be incessantly expressed as after-tax or before-tax figures and must not be interlaced together at the time of integrating the different costs.

Another factor is that the true cost of inventory does not only revolve around one element or two but generally goes far beyond the raw materials or the final products and the price of the products.

Following this maintenance expenses and managing costs is other factors to be considered. The list still continues when you add interests, abatements, and insurance. Definitive planning is needed to determine where to start and how to determine one’s inventory costs.

While there can be an easy way to calculate an estimate for some of these factors you should keep in mind that all these factors are extremely discrete in terms of the different kinds of businesses and depends largely on management and policy settlements.

Methods of Inventory Costing

After the unit cost of the inventory will be determined, specific costing techniques have to be applied. Therefore every unit of inventory cost will have different costs and a basis of presumption needs to be implemented to maintain an organized procedure of assigning costs to the inventory units.

Following are some methods of inventory costing:

Specific Identification Method

Every component’s pricing which forms a part of the inventory is tracked exclusively using this technique. The closing stock is calculated after this and the cost of goods is included as well.

This technique is an elaborate one so it can only be used with significantly large items like automobiles or products that can generate a high value or are unique. Since in most cases it is not an efficient method to assign a cost to every component of an inventory, therefore specific identification method is not preferred.

First in First Out (FIFO)

Under the First-in, First-out inventory method, an operation follows a methodology of costing which operates under the presumption that the cost of inventory that has recently been purchased should be represented by the cost of inventory in hand at any specified period of time which means that when during the time of selling off inventory the oldest costs i.e. the cost of products for the oldest inventory is interconnected to the sale.

First-in, the First-Out inventory costing method is the technique that is most precisely coordinated to the authentic buying cycles in which the oldest inventory is the first one that gets sold off. This is of utmost importance in the case of products such as perishable products, medicines, and food products, items which can be out of date or expire briskly.

Last In First Out (LIFO)

Under the Last-in, First-out inventory costing technique, an operation is executed in the exact opposite methodology when compared to the first-in-first-out methodology. When using LIFO to make sales, the most recent inventory products are interlinked with the sale.

LIFO is not tied to the general cycle of buying so it may seem to be an absurd method of inventory costing for some operations. It is impractical as compared to FIFO in many cases as a matter of fact. Although it may not make sense, LIFO can be used as a convenient method for certain kinds of operations such as those operations where LIFO reflects the buying cycle.

Take the supplier of wood chips as an example. Wood chips in many operations are stored in big piles and it becomes difficult to move or rotate these types of products, unlike some other goods. New wood chips created and brought in are placed on the top while the older ones get buried at the bottom.

Workers usually tend to grab the products that are stacked up on the top of the piles first since the older chips are placed under the newer ones. Associating the products sold with the newer inventory costs rather than the older ones allows for inventory costing to be more precisely matched with that of the flow of inventory.

Average Cost/Weighted Average

Under the average cost inventory costing methodology, an operation will allocate costs to the sold inventory by calculating the average cost of all the buying inventory units. Every piece of inventory then gets allocated with the average cost in lieu of the age of the inventory or the costs linked to the time of purchase.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How can Lio assist you?

‘One app for all your data. One phrase tells us a lot. Lio is an efficient mobile application that can assist emerging businesses and entrepreneurs in various ways. Lio gathers all the data and files that you want, and arranges them in a manner that will make them seem attractive and easy to go through and you can access them from your android device whenever and wherever you want.

This app can be used to systematically organize important reports, sales and business reports and plans, duties and details of employers and staff, financial data, details of customers, profit and loss proportion tracking, etc so that you can manage your business without much hassle.

The most noticeable convenience provided by Lio is that it saves your money and time since a simplified source of keeping track of and checking up on company data and reports helps an individual spend lesser time scurrying through a plethora of unsynchronized and disorderly sources of data.

Lio is used by many business leaders to keep track of a variety of data, including employee details, news, and other such details. Lio also has the option to allow access to multiple recognized users so that individuals can get access to the documents whenever they want.

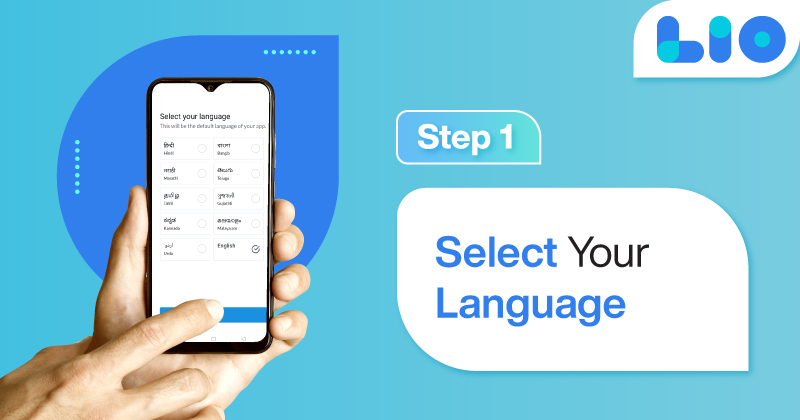

Step 1: Select the Language you want to work on. Lio on Android

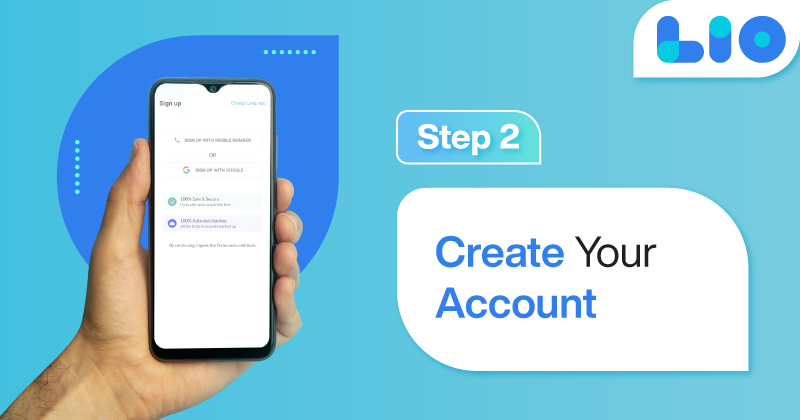

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template to which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

The method of inventory costing you choose to apply will ultimately depend on the major factors involved such as how your industry operates, how the goods are manufactured, how are orders handled and processed, how is inventory managed, and some other prominent characteristics specific to your enterprise.

You can opt for consulting a professional systems integrator or a warehouse designer specialist who will help you understand the details of your operation and will help you in selecting one of the strategies that will serve your purpose in the best way possible.

Frequently Asked Questions (FAQs)

How many Types of Inventory Costing Methods are there at Present?

At present, there are three main types of inventory costing methods for you to choose from.

Which Inventory Costing Method should turn out to be the Right One for me?

This factor depends entirely on what kind of products your business manufacture. You can opt-out of an inventory costing method depending on what is suitable for you.

Do Items in the Inventory usually have the same carrying cost?

No, the carrying cost of items in the inventory differs due to varying weights of items, different sales volumes, etc.

What kind of Products should I assign the method of FIFO to?

Items that are easily perishable and can expire soon should be prioritized under the FIFO methodology.