Applying for a Small Business Grant: Tips and Resources

Applying for a small business grant and want to make sure you know what you are doing. Read the detailed article to know everything about it and how you should go about it.

Starting a business requires a lot of financial support, and most small business owners often find themselves in need of extra funding. One viable option for small businesses is applying for a business grant.

However, the process of finding and applying for a grant can be overwhelming and confusing, especially if you are new to the process. In this article, we will discuss what a business grant is, where to find them, and what you need to do before applying for a small business grant.

What is a Business Grant

Before we jump into applying for a small business grant, let us first understand what a business grant is. A business grant is a sum of money that is awarded to a business by a government agency, non-profit organization, or private corporation.

Grants are not required to be repaid and can be used for a variety of business-related purposes, including startup costs, expansion, research and development, and marketing. The main difference between a grant and a loan is that a loan requires repayment with interest, while a grant does not.

Where To Find Business Grants

When applying for a business grant, you should know where to look for it. Following are all the places where you can find business grants.

- Federal Grants: The US government provides grants for small businesses through various agencies, including the Small Business Administration (SBA), the Department of Agriculture, and the National Institutes of Health.

- State Grants: Most states have grants available for small businesses, and these grants can be found through the state government’s official website or the state’s economic development agency.

- Private Grants: Many private corporations and foundations provide grants to small businesses. These grants can be found through a variety of sources, including online directories, grant databases, and business associations.

- Crowdfunding: Crowdfunding platforms like Kickstarter and Indiegogo allow small businesses to raise funds from the general public in exchange for rewards or equity.

- Non-Profit Organizations: Non-profit organizations like SCORE and the National Association for the Self-Employed provide grants and other financial assistance to small businesses.

Why Look for Grants for Small Businesses

Small business grants can provide a significant financial boost to your business, without the burden of repayment. Grants can help fund research and development, hire new employees, expand your operations, and more.

Additionally, receiving a grant can provide credibility to your business and help attract investors. Hence applying for a small business grant is one of the best and most important steps for a company to grow.

What To Do Before Applying For A Small Business Grant

Before applying for a small business grant, here is everything that you must do to make sure that your applications make it through the eligibility.

- Research: Do your research and determine which grants are the best fit for your business. Look at the eligibility requirements, deadlines, and funding amounts.

- Create a Business Plan: A business plan is essential for any small business, and it’s especially important when applying for a grant. Your business plan should outline your business goals, target market, financial projections, and marketing strategies.

- Gather Documentation: Grants require a lot of documentation, so make sure you have all the necessary paperwork in order. This can include tax returns, financial statements, and business licenses.

- Network: Networking with other small business owners and industry experts can provide you with valuable insights into the grant application process and may even lead to funding opportunities.

- Get Professional Help: If you are struggling with the grant application process, consider hiring a grant writer or consultant to help you navigate the process.

How To Apply For Grants For Small Businesses

If you’re a small business owner looking for funding to grow your business, grants can be an excellent option. Grants provide funds that you don’t have to pay back, unlike loans, which can help your business without putting you in debt.

However, applying for a small business grant can be a complex and competitive process. Here are some steps to follow to improve your chances of receiving a grant for your small business:

Research available grants

Before you start the application process, you’ll need to identify grants that are available to your business. This will require some research, as there are many different types of grants available from various organizations, such as the government, non-profits, and corporations.

You can start by searching for grants related to your industry, location, or specific business needs. Websites like grants.gov and the Small Business Administration (SBA) provide comprehensive databases of available grants. You can also look for grants offered by state and local government agencies, as well as by private foundations and corporations.

Determine your eligibility

Once you’ve found some grants that seem like a good fit, it’s important to determine whether you’re eligible to apply. Each grant will have specific requirements, such as business size, industry, location, or type of project. Be sure to carefully review the eligibility criteria for each grant you’re considering to make sure you meet the requirements.

Prepare your application

The next step in the process of applying for a small business grant is preparing your application. Once you’ve identified a grant that you’re eligible for, it’s time to start preparing your application. This will involve gathering information and documents about your business, such as financial statements, tax returns, and a business plan.

You’ll also need to write a compelling grant proposal that explains why your business is a good fit for the grant and how you plan to use the funds. Your proposal should be well-written, concise, and tailored to the specific grant you’re applying for.

Submit your application

Once you’ve completed your application, be sure to review it carefully to ensure that you’ve provided all the necessary information and that there are no errors or typos. Then, submit your application according to the instructions provided by the grant organization.

Follow up

And the last one in the process of applying for a small business grant is to follow-up. After submitting your application, you’ll likely have to wait several weeks or months to hear back from the grant organization. In the meantime, it’s a good idea to follow up on your application to ensure that it’s being reviewed and to address any questions or concerns that the grant organization may have.

In conclusion, applying for grants for small businesses can be a time-consuming and competitive process, but it can also be a valuable source of funding for your business. By following these steps and carefully researching and preparing your application, you can increase your chances of receiving a grant to help your business grow.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio can Help You?

To make your dreams come true of having a business of your own and managing it nicely, Lio App can help you big time. The app lets you keep all sorts of data together in a more organized manner. You can keep records, and create tables and lists while working solo or with a team.

The many features of Lio would help you with your retail business as you would be able to maintain all data on a track that you can use at any time. If you want to upload a document, then you can do that. Know the money transactions, cash inflow, profit and loss you are making, Udhaar, list of products, services, and even the teammates and clients that you have all in one place.

Your retail business ideas will certainly become successful businesses if you go on this journey of managing your business with Lio.

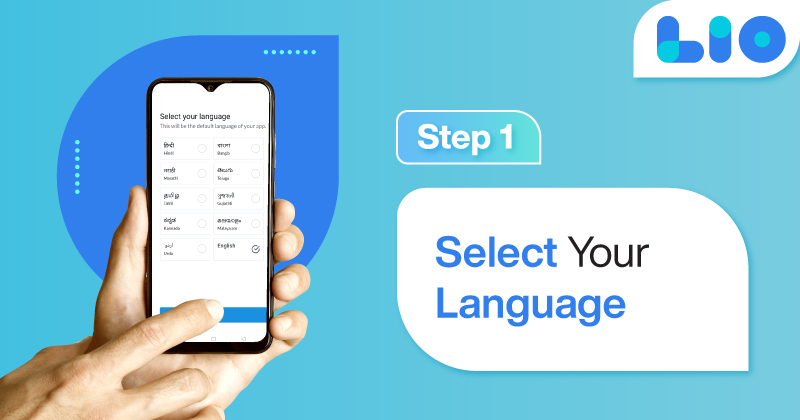

Step 1: Select the Language you want to work on. Lio on Android

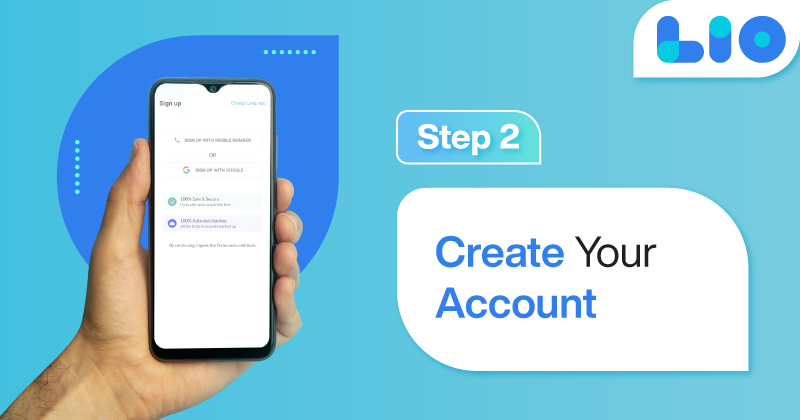

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

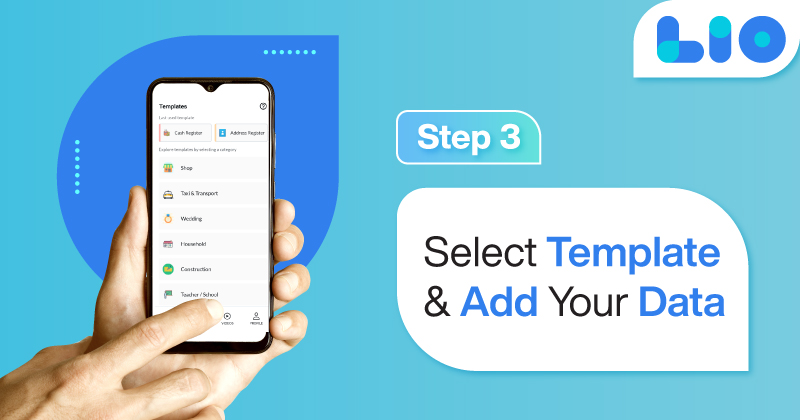

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Applying for a small business grant can be a great way to secure funding and support for your business. With a variety of grant programs available from different organizations, it is important to research and identifies the programs that are the best fit for your business goals and needs.

Before applying, be sure to carefully review the eligibility criteria and requirements, and consider working with a grant writer or consultant to increase your chances of success. By taking these steps, you can position your small business for success and growth.

Frequently Asked Questions(FAQs)

What is a small business grant?

A small business grant is a sum of money given to a small business by a government agency, nonprofit organization, or private foundation to support its growth and development.

Unlike a loan, a grant does not have to be repaid, but there may be certain requirements or conditions attached to the funding.

Who is eligible for a small business grant?

Eligibility for a small business grant depends on the specific requirements of the grant program.

Generally, grants are available to businesses that meet certain criteria, such as being owned by a woman, minority, or veteran, having a certain number of employees, or operating in a specific industry or geographic area. Some grants may also be available to businesses that are developing innovative products or services.

How do I find small business grants to apply for?

You can find small business grants to apply for by researching government agencies, nonprofit organizations, and private foundations that offer grant programs.

You can also search for grant opportunities on websites such as Grants.gov, the Small Business Administration’s website, and Foundation Center.

What should I include in my small business grant application?

To increase your chances of receiving a small business grant, you should include a detailed business plan that outlines your goals, target market, marketing strategy, and financial projections.

You should also explain how the grant funds will be used and how they will help you achieve your business objectives. It is important to carefully follow the application instructions and provide all required documentation.

How long does it take to receive a small business grant?

The time it takes to receive a small business grant varies depending on the grant program and the application process. Some grants may be awarded within a few weeks, while others may take several months or even a year.

It is important to carefully review the grant program guidelines and timeline, and to be patient and persistent in following up on your application status.