Understanding Sales Return Journal Entry With Examples

Here is an article explaining you everything about sales return journal entry and more with examples.

In mostly all businesses, some customers might get broken, faulty, or even low-quality products which they can either return to the seller or even hold the product with them at a much-reduced cost.

The situation where the customer returns the product to the seller is called a sales return. And the situation where the customers hold the product at lower prices is called a sales allowance.

Companies hold both these records in a single account.

What Is Sales Return Journal Entry

In terms of payroll journal entry, a sales return can be defined as one that can be used to account for the customer’s returns in the account books or to account for when there is a return of goods due to defective goods or any other reason.

The journal entry that shall be passed in the account books for an accounting of sales return would be as under.

#1 – When goods are returned, and no receivables were outstanding.

| Date | Particulars | Debit | Credit |

| 1st April | Sales Account | XXX | |

| Cash Account | XXX | ||

| Inventory Account | XXX | ||

| Cost of Goods Sold | XXX |

#2 – When goods are returned, and receivables were outstanding.

| Date | Particulars | Debit | Credit |

| 1st April | Sales Account | XXX | |

| Receivables Account | XXX | ||

| Inventory Account | XXX | ||

| Cost of Goods Sold | XXX |

Essential Points about Sales Return Journal Entry

- The revenue of the firm is reduced, by debiting the Sales account, which will impact the gross margin of the company.

- The cost of inventory is adjusted for margin and goods sold because sales return hasn’t earned any revenue for the firm, so profit should also be reversed.

- Many companies sell goods on either a cash basis or a credit basis. Therefore the ratio maintained should be checked, and the entry should be passed if the customer’s details are unknown.

- The cost of goods sold is adjusted as the inventory increases the sales return. Whether it is on cost or sales, the gross margin should be noted. If it is on sales, then one can directly reduce sales amount by that margin, but if it’s on cost, one needs to adjust for weight.

Examples of Sales Return Journal Entry

Example #1

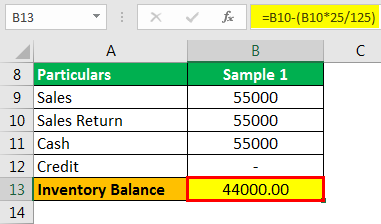

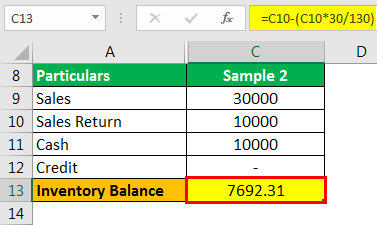

Cycle and Bike Inc. sell Cycle and bike on both cash and credit basis, on an almost equal ratio. Mr. Aditya, an auditor in this company, draws out two random samples to validate whether the company is recording journal entries accurately. The balances reported should be fair and accurate.

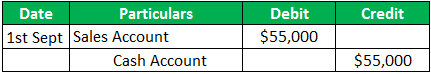

- 1st Sample: A bike for $55,000 was sold to Kevin who paid the entire amount in cash on 1st September, and due to a defect in the bike, he returned the bike to a company on 20th September. Entire remits due to him were paid back to him on the same day.

- 2nd Sample : 3 cycles were sold for $30,000 to Miley who paid for one Cycle in cash on 4th September, and for the rest, the payments were outstanding. Since the Cycle had some scratches, it was returned on 6th September, and the rest two were retained. Since she has an exceptional amount that was adjusted against the same, the balance would be received from her.

The Gross margin on bikes was 25%, and on the Cycle, they earned 30% on cost. Therefore, based on the above information, you must pass sales return entries.

Solution

Let’s calculate first the sales return value and adjustment that has to be made to the cost of goods sold.

- 1st Sample: Sales for $55,000 will be adjusted for a 25% gross margin, which can be computed as 55,000 x 25 / 125, which shall equal $11,000, and the amount that will be added to inventory would be $55,000 – $11,000, which is $44,000.

The Journal Entries would be-

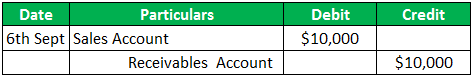

- 2nd Sample: Sales for $10,000 ($30,000/ 3) will be adjusted for a 30% gross margin, which can be computed as $10,000 x 30 / 130, which shall equal 2,308, and the amount that will be added to inventory would be $10,000 – $2,308 which shall be $7,692.

The Journal Entries would be-

Example #2

George is running a retail shop. He sells his products. He mentioned in his invoice that if the customer buys the products and in case of any damage or other issue, then products can be returned within 30 days.

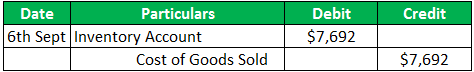

For June 2020, he made $6,00,000 in sales (sales made on a cash basis is 40% and sales made on a credit basis is 60%). The outstanding receivables of George’s company are $3,00,000. He has $1,00,000 as cash on the balance sheet, at the end of August 2020. The COGS was $5,00,000. And the remaining balance on closing inventory is $4,00,000. 10% of Geroge’s sold goods, were noted as returned goods due to product damage. George’s gross margin on sales is 30%.

With the above-mentioned detailed report, George needs to pass the sales return journal entries. Additionally, the estimated remaining remains on sales, cash, inventory, receivables, and the COGS (Cost of Goods Sold).

Solution for the above example information

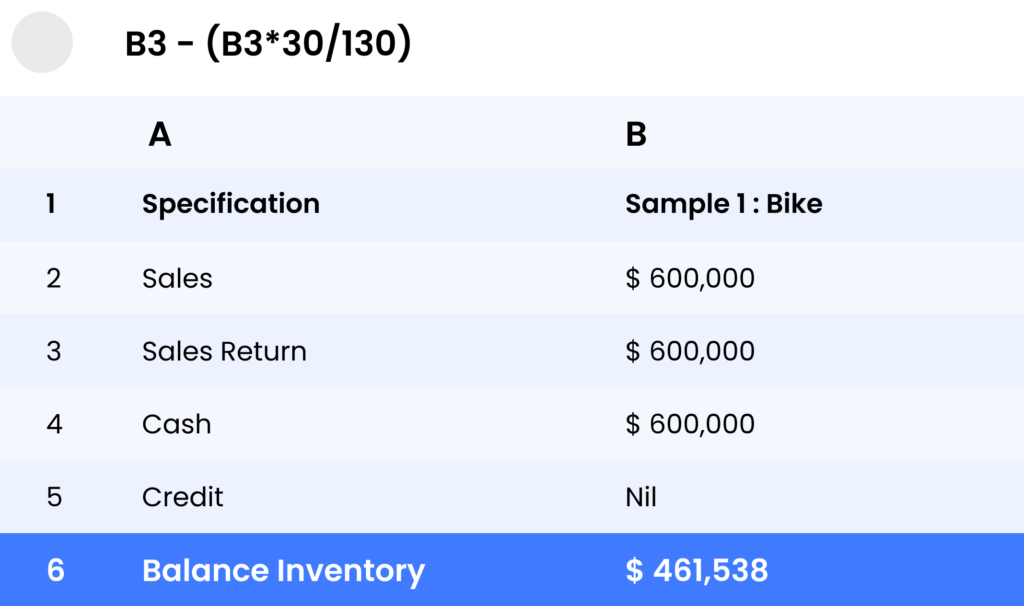

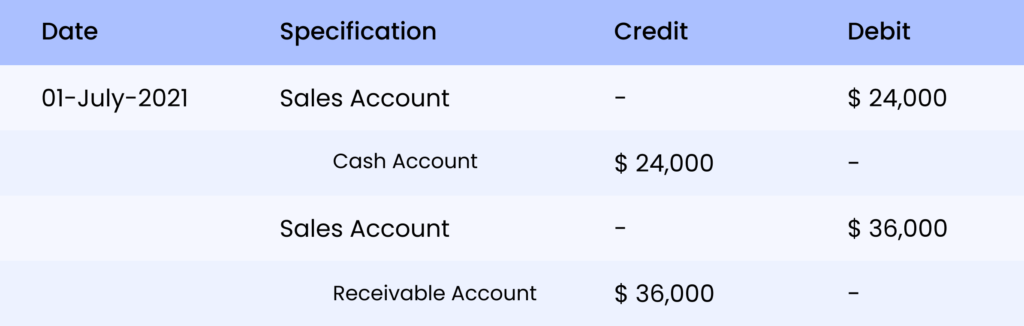

First, calculate the amount of sales return. Here the sales return is 10% of $6,00,000 (thus, 10% of $6,00,000 is $60,000). Now, George passes the journal entry. He assumes the ratio of 40% return is based on cash and the balance of 60% return on receivables. As a result, a cash account credited by 40% of $60,000 is $24,000. The receivables account credited by 60% of $60,000 is $36,000.

Moreover, the inventories are limited by $60,000, which is less than 30% of the margin, which is $60,000 less than $18,000 i.e., $42,000 ($60,000 – $18,000), that will be to added inventory items and limits the COGS similarly.

Therefore,

Sales return journal entry

Adjustments to COGS

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Can Lio Help You

To make your dreams come true of having a business of your own and managing it nicely, Lio App can help you big time. The app lets you keep all sorts of data together in a more organized manner. You can keep records, and create tables and lists while working solo or with a team.

You can assign tasks to your team members who can get notified about it. You can see their daily tasks, progress, and everything else on Lio. You can also view the dashboard to see how the team is performing and how close they are to meeting the target.

The many features of Lio would help you with your retail business as you would be able to maintain all data on a track that you can use at any time. If you want to upload a document, then you can do that. Know the money transactions, cash inflow, profit and loss you are making, Udhaar, list of products, services, and even the teammates and clients that you have all in one place.

Your retail business ideas will certainly become a successful businesses if you go on this journey of managing your business with Lio.

Step 1: Select the Language you want to work on. Lio on Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Hope by now you have understood what sales return journal entry is and know how businesses make use of them and record these entries in the account books. These are also important aspects of a business and are done by companies all over the world.

Frequently Asked Questions (FAQs)

Is Sales Return Debit or Credit in Journal Entry?

The seller records this return as a debit to a Sales Returns account and a credit to the Accounts Receivable account

Is Sales Return recorded in the Sales Journal?

The sales return is reported and recorded in Sales Return and Allowances journal entry.

Are sales return an expense or revenue?

The sales returns have a direct impact on the net income, thereby deducting the income hence it is not an expense, but they contribute to the income loss.

What is the difference between sales return and purchase return journal entries?

– Sales return is nothing but the goods returned by a customer to the seller.

– Purchase return is operated for documenting the goods bought from the supplier which are returned to the supplier.