How To Save GST: The Right Way To Do So

Wondering how to save GST ethically without committing fraud? You have landed at the right spot! This article provides detail about how to save GST.

What is Input Tax Credit?

The term “input tax credit” refers to claiming a credit for GST paid on the purchase of the goods and services that are employed in the course of business.

The Input Tax Credit Mechanism is the cornerstone of GST and one of the most essential reasons for its implementation.

Because GST is a single tax charged across India (from the time goods/services are manufactured until they reach the final customer), the chain is not disrupted, and everyone may benefit from it, ensuring a smooth flow of credit.

Why Buy From A GST Registered Dealer And Not A Composite Dealer?

Even though a GST registered dealer can buy from an unregistered dealer or a composite dealer, the registered dealer will not be able to claim input tax credits for such purchases since a composite dealer cannot charge or collect GST on its sales.

This will limit the registered dealer’s ability to obtain tax input tax credit benefits and raise the price.

As a result, if a registered dealer buys from another registered dealer, he may take advantage of the ITC benefit and lower his costs.

How To Save GST: Some Other Ways To Save GST?

Changes in Investments

You will pay IGST on your purchase if you increase your inter-state purchases, which is a very advantageous situation because IGST ITC may be set off with CGST liability and also SGST liability once you have set off your IGST liability.

However, if you make an intra-state purchase, you will see that SGST ITC can only be applied to SGST and IGST liabilities, whereas CGST ITC can only be applied to CGST and IGST liabilities.

As a result, if you want to reduce your GST payment, choose Inter-State goods/products over Intra-State goods/products.

If you’re in the manufacturing industry, setting up a production facility in one state/union territory and a sales depot in a separate state/union area is a good idea.

Accept Your Sales Consideration As A Deposit Without Settling Your Customer Receivables

- As per the definition of consideration as per section 2 (31) of CGST Act, 2017, Consideration in relation to supply of the goods or services includes:

- Payments you made for inducement of, the supply of goods or services. This can be as money or otherwise by the recipient or any individual minus any subsidy that they received via the central and state governments. .

- The monetary value of any act or forbearance, whether or not voluntary, in respect of, in response to, or for the inducement of, the supply of goods or services. This is done by the recipient or any other individual and does not include any subsidy received from Central or a State Government:

- PROVIDED any deposit made keeping in mind the supply of the goods or services or both of them isn’t counted as a payment made for such supply unless the supplier applies the deposit as consideration for the said supply.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio Can Help?

Lio is a mobile integrated app that helps in maintaining the records of the activities as well as used for storage of other personal data and keeps it safe and secured so that the users know that their data will not get corrupted from any outer source.

The app helps in categorizing, making folders, and storing data of various activities.

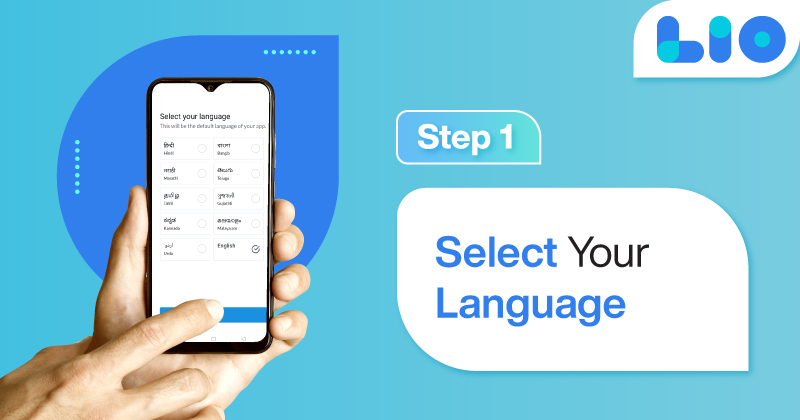

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

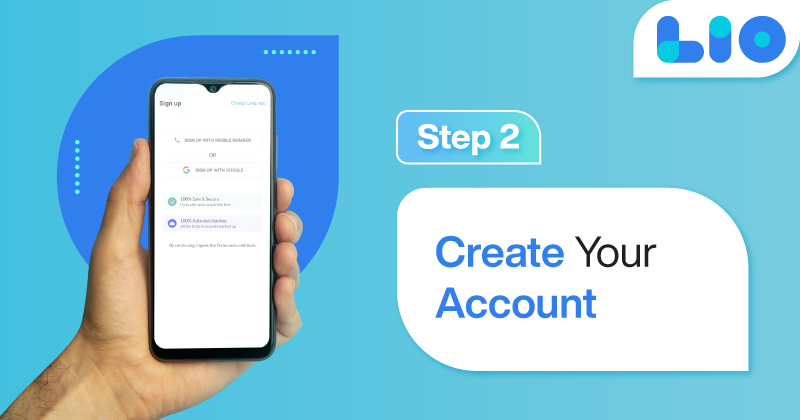

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

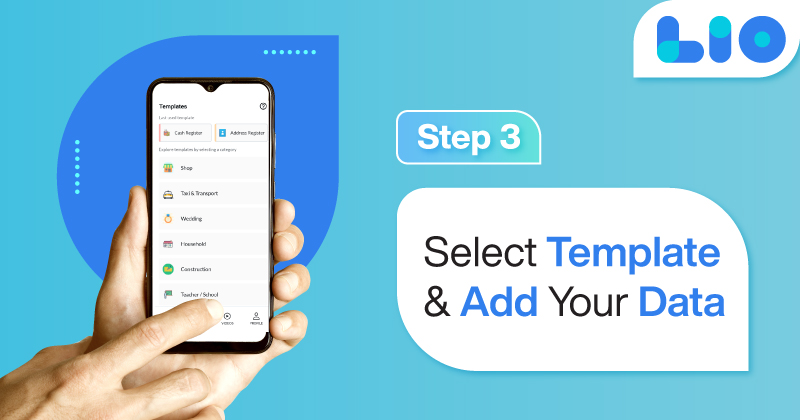

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

GST is largely seen as a major game-changer in the Indian economy, with socioeconomic ramifications.

While some may feel the pinch when purchasing high-end things, the advantages are intended to gradually trickle down to the public.

The absence of the cascading tax impact is likely to lower commodity prices considerably from their current level.

If managed carefully, the small money that business owners may set aside following the adoption of GST can provide them with long-term benefits.

Frequently Asked Questions(FAQs)

What is Input Tax Credit?

The credit of input tax on the supply of goods or services, or both, received by a registered person is known as an input tax credit.

What are the requirements for receiving an ITC?

The registered taxable person must meet the following four requirements in order to get ITC:

– He has a tax invoice or debit note, or other tax-paying papers (such as a bill of entry or other document required by the Customs Act, or an ISD invoice as defined in Rule 36(1) of the CGST Rules).

– The products or services, or both, have been delivered to him;

– The provider has paid the government the tax due in connection with the supply, and

– He has filed the required section 39 return.

Is it possible to use the reverse charge ITC from a previous month to the current month’s liability?

ITC cannot be claimed for taxes paid under the reverse charge system. As a result, reverse charge liability must be deposited exclusively through an electronic cash ledger.

Furthermore, the amount of taxes paid via reverse charge can be applied to the next month’s production tax due under regular charge.

Is it possible to claim ITC for products like chips, cold drinks, and items purchased for employee refreshment, insurance, Etc.?

Employee refreshments will not be eligible for ITC under GST since they are covered under the Negative List of ITC. Input tax credits for automobile insurance and car maintenance, on the other hand, are available.

Is it possible for someone who is not registered for GST to claim ITC and collect tax?

No, a person who is not registered for GST cannot collect GST from his clients or claim any GST paid as an input tax credit.

10 Comments

Could you help explain the differences between GST Schedules 2A and 2B?

Hello Drona,

The GSTR-2A is an interactive statement that is updated each time a taxpayer’s suppliers submit their GST return for outbound supplies. The GSTR-2B, on the other hand, is a static statement that only includes information about an individual return period’s input tax credit.

“Why should you purchase from a GST-registered dealer rather than a composite dealer?” This is a question I’ve always had, but I now understand. I sincerely appreciate all of your efforts.

Hello Sudheesh,

Thank you so much for your warm words.

I am delighted that I was able to dispel your doubts.

Keep reading!

This is just incredibly informative. All people should be knowledgeable of this, thank you very much for sharing such valuable information.

Hello Ludhiya,

Thank you so much for your kind words.

I’m so delighted that you found this article to be so instructive.

Keep reading!

In the past 6 days, my new GST registration has indicated that a clarification was filed and is awaiting an order. What does that mean?

Hello Oviya,

The GST authorities have seven working days to approve or reject your request for clarification before the deadline has passed. If they don’t respond within the specified time, your GST number will be assigned automatically, and you’ll get the information on your registered email.

Furthermore, if the Tax Official is not satisfied with the information provided by you in the Registration Application or the documents attached, the Tax Official may seek clarification from the taxpayer.

I want to start a business from home; is it possible to register for GST at my residential address?

Hello Hamel,

Yes, you can sell things from your house and register it as your place of business for GST purposes. You must, however, get a no-objection certificate (NOC) from your parents if the residence is registered in their name. The NOC must be supplied along with the other necessary paperwork required for GST registration.