Delivery Challan- Meaning, Format and Template

Delivery Challans is a helpful tool in the safe transportation of goods as they assist in tracking and verifying the contents of delivery. In case you are unfamiliar with the term, below we have provided the meaning, format, and template of a Delivery Challan.

A tax invoice is produced for each trade of goods or services made under GST. Conversely, some transactions are not considered supplies but must be moved from one location to another.

It delivers a piece of machinery from one location to another and gets it back when the task is completed, sends commodities to some other office within the state, and so on. Since it is not a supply in all of these circumstances, a tax invoice cannot be produced, and a delivery challan must be provided instead.

Moreover, it is usually the case that the receiver makes the payment instantly following a goods-and-services transaction. However, the payment might take a little more time in some circumstances. In such cases, the provider issues a delivery challan that specifies the costs of the goods and services.

Is all this information about Delivery Challan putting you in a state of confusion? No need to worry! This article explains what a Delivery Challan is and a detailed format and its usage.

What is a Delivery Challan?

A tax invoice must be filed whenever a licensed provider transfers taxable items from one location to another, as per Section 31 of the CGST Act, 2017.

The number of products, their specification, price, GST imposed on them, and other information required by Section 31(1) of the Act is included on this tax invoice.

However, in other circumstances, the movement of goods does not give rise to a sale or supply, and hence no tax invoice is generated. Rather, a delivery challan is produced in such circumstances.

Suppliers utilize the delivery challan format to convey items that are not meant for instantaneous sale and generate a delivery challan.

Therefore, a delivery challan is a document that is produced when items are transferred to another location but are not intended for selling, and no GST is charged on such a shipment.

A dispatch challan or delivery slip is another name for a delivery challan. It includes information on the products being transferred.

For instance, if a factory transports items from one storehouse to the other, this challan will be generated.

Delivery Challan Meaning

A delivery challan is a formal document required to transfer commodities from one location to some other, that might or might not conclude in sales.

This delivery challan accompanies the items that are being delivered. The majority of the information on this delivery challan pertains to the products supplied, the number of goods labeled for delivery, the purchaser’s address, and the shipping address. For delivering challans, there are three main types of copies made. Those are:

- Original Delivery challan is issued to the buyer

- A duplicate is given to the Transporter

- A third copy of the Challan is for the Seller

A delivery challan, also known as a slip of delivery or a dispatch challan, is a document that contains information about the items being supplied, such as quantities, shapes, and specifications.

The recipient’s information and the delivery place and time are all included in this challenge. The primary objective of a delivery challan is to facilitate the transfer of goods.

It should be emphasized that the delivery challan is borne with the items being conveyed. It is a significant document that is required in almost every business transaction on a daily basis.

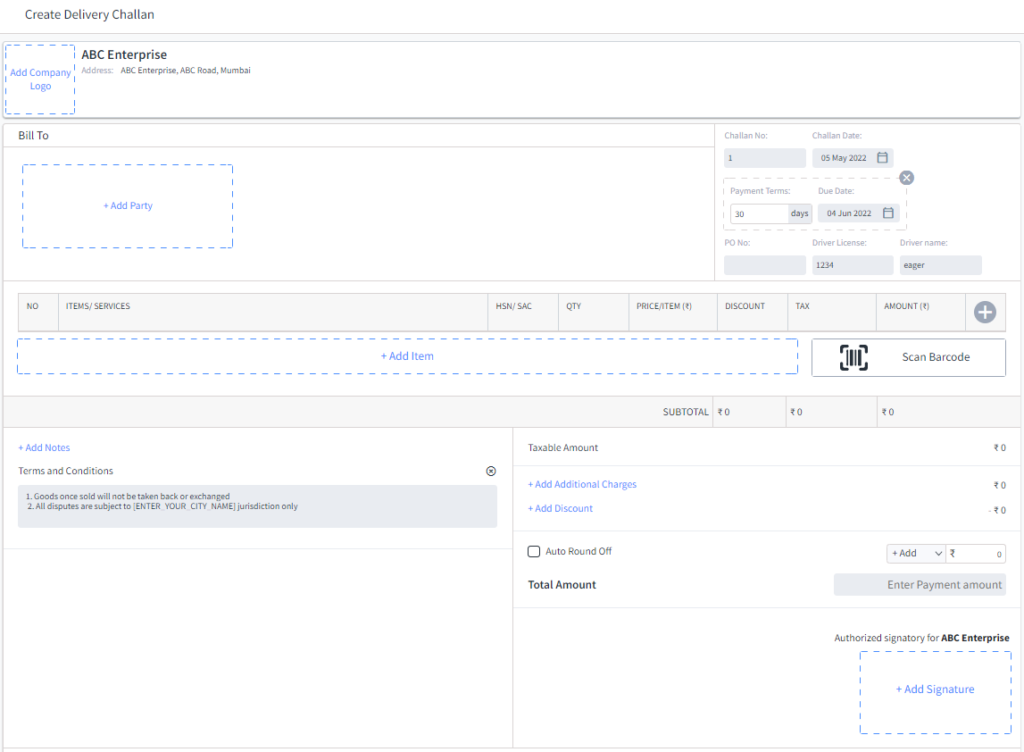

Format and Template of a Delivery Challan

A Delivery Challan must be given when items are transported or transferred within or beyond the state borders with authorization to sell or return and are withdrawn before the delivery occurs.

GST requires these Challans to be serial numbers that should not exceed sixteen characters in one or more series.

The challan must be shipped with the items under GST since it provides vital information about the commodities in transit, such as the amount, buyer, and delivery address.

It includes the fine print of the items transported, the amount of these items, and the buyer’s info and other delivery information.

The seller may offer the consumer flexibility in payment, such as bank transfer, cash, or cheque.

Format of a Delivery Challan

To generate a Delivery Challan, you need to include the following details on the document.

- Date and the number of the challan

- Serial number of the challan

- Name and address of the registered vendor

- Name and identity of the buyer with specifications

- Quantity and the description of the goods, inclusive of their HSN code

- Name and address of the transporter, also known as a consigner

- Place of delivery of goods

- Signature

Record the precise information of the items, like their taxable value, description, and HSN number, to create an error-free challan.

It should be highlighted that the delivery challan serial number is important since it facilitates in identifying and making future references smoother. Furthermore, if the individual receiving the items is not registered, the business’s address must be explicitly stated in the delivery challan.

How to use this format of a Delivery Challan?

The delivery challan format makes it simple to generate a challan. You may use the empty template provided, enter the information in the columns on the template and take a printout.

The template would be printed, and it would have all of the relevant information on the shipped products. You can sign the challan and mail it with the items conveyed to the addressee.

Why does a supplier need a Delivery Challan?

Suppliers can furnish a delivery challan in place of an invoice in certain circumstances, according to Section 55(1) of the CGST Rules. Such cases where a Challan can be issued under GST are listed below.

- When the amount of items delivered is unknown, take the example of liquid gas when the volume of gas extracted from the provider’s site is uncertain.

- When supplies are being transferred in order to complete a job. The delivery challan is required in either of the below situations:

- If a principal is delivering items to a worker on the job

- If one employee transports items to another employee

- If the employee is returning products to the principal

- Before the commodities are finally provided, they must be transported. The movement of items from a manufacturing unit to a warehouse or between storehouses is an example of such a circumstance.

Furthermore, in some situations, providing this challan in an approved format is required for the transportation of goods. The following are cases of such situations:

- When commodities are conveyed on the grounds of approval, a challan is required if items are transferred inter or intra-state on a sale or return basis and then retrieved before the delivery transpires.

- If a work of art is brought to a gallery. If art pieces need to be carried to galleries for display, these challenges can be used.

- Transporting products to another country for promotional or exhibition purposes. According to CBIC Circular No. 108/27/2019-GST dated July 18, 2019, articles delivered outside India for display or promotion cannot be classified as “supply” or “export.” As a result, such transport should be done according to this challenge.

- Multiple shipments of items are transported. If items are carried in a partially or fully finished condition employing several modes of shipping, the provider must produce a tax invoice when shipping the first consignment. Then, for each succeeding shipment, a challan should be issued with reference to the invoice.

- When generating a tax invoice during the removal of items is not feasible. Suppose the items being carried are intended for sale or distribution, but the provider cannot submit a tax invoice. In that case, the supplier can provide a delivery challan and convey the goods, according to Rule 55(4) of the CGST and SGST Rules, 2017. After the items are received, the tax invoice will be provided.

- When you don’t require an e-way bill, the items shall be carried using the delivery challan if the e-way bill is not requested, and in circumstances where the tax invoice or Bill of Supply is not required, as per Rule 55A of the CGST Rules, which took effect on January 23, 2018.

Components of a Delivery Challan

The following are the primary components of a Delivery challan:

- The date of generating the challan and its number. Keep in mind that the Challan should be numbered serially

- It should bear the consignor’s name, address and GSTIN number

- It should also have the consignee’s name, address and GSTIN number. In case the consignee is not registered, the Challan should have the place of supply

- It should mention the HSN codes of all the goods that are transported

- It should include a description of the items supplied

- It should contain the provisional or exact (if possible) quantity of the items that are being supplied

- It includes the amount of supply that is liable for tax

- It should bear a clear breakdown of the applicable GST into IGST, CGST, SGST and cess.

- It should include the place of delivery if it is an inter-state transfer

- Lastly, it should have the signature of the supplier or any of their designated authority

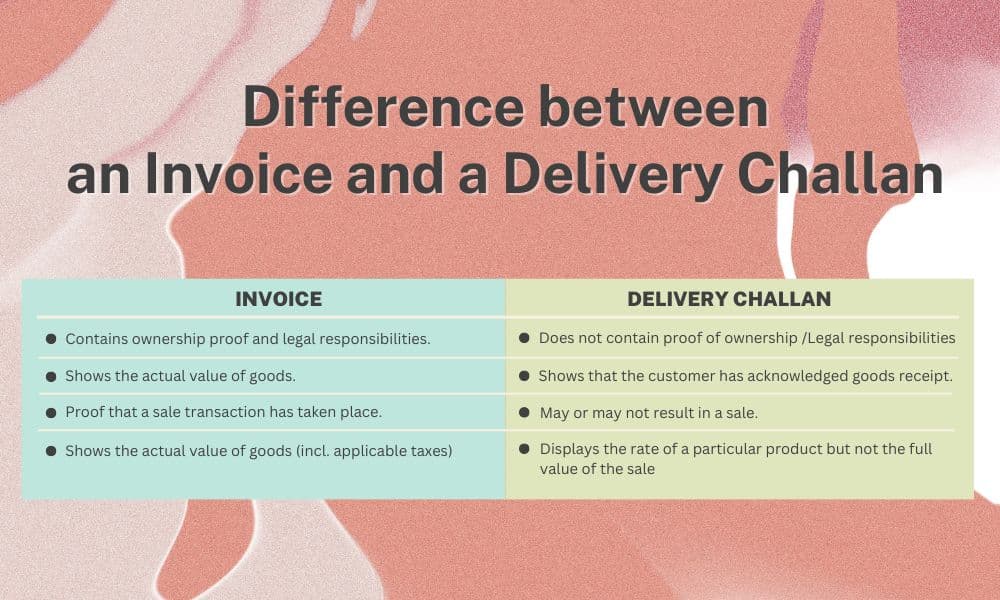

What is the difference between an invoice and a Delivery Challan?

An invoice is a document that proves the legal ownership of goods by the consumer. For a consumer, the invoice is not just a sheet of paper.

It is proof that the customer has agreed to undertake complete ownership of the items that are inclusive of all rights, risks, and liabilities that come with the goods in question.

When commodities are transported in many shipments and are semi-knocked down or entirely knocked down, the vendor must submit a complete invoice before dispatching the principal shipment and a delivery challan for each of the subsequent consignments with reference to the invoice.

A challan fulfills the solitary function of establishing that the consumer has recognized the reception of goods, but not their legal ownership or liabilities, as previously stated.

Another minor distinction between these documents is that an invoice mentions the specific amount of the goods provided, but a challan does not.

Nonetheless, a challan may appear to suggest the value of goods in certain situations, but it will never indicate the tax imposed on a consumer.

It’s also important to mention that an invoice and a challan can be combined to create a Tax invoice cum delivery challan.

What sort of businesses need a Delivery Challan?

As previously stated, a delivery challan is useful in various situations involving the transfer of items that are not intended for sale. The following are some examples of businesses that require these challans under GST:

- Enterprises that deal in the exchange of goods are often known as trading businesses.

- Owners of many warehouses with goods being transferred between them regularly

- Businesses involved in supplying or distributing goods businesses that deal with the wholesale of products

- Manufacturing units

Delivery Challan Template

Here’s the delivery challan template that can help you understand.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How can Lio help?

With Lio, you can organize all of your content on one site and access it on your phone whenever you want with just a few clicks.

You may use this software to record your revenue and expenses, produce multiple lists, etc. You may collaborate in real-time with your colleagues by effortlessly generating documents together and sharing them via Whatsapp, Gmail, and other social media platforms.

You may use the app on your smartphone instead of a laptop or PC because it was created exclusively for mobile users. For a rich user experience, the app intertwines with your phone’s communication apps.

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Any successful corporate organization should cultivate a culture of record-keeping. Accounting records and other essential documents should be preserved in order to maintain records. The delivery challan is one such document.

Where CGST regulations rule 55A of CGST Rules introduced w.e.f. 23-1-2018 does not need a person to carry an e-way bill, and where there is no necessity for a tax invoice or Bill of Supply, the Challan shall escort the goods.

You may help centralize this operation by using inventory management software like Lio. Lio makes it far easier to keep track of inventory purchases and sales. It only takes a few clicks to create a sales order and a delivery challan.

I hope you benefit from this article and make the most of it.

Frequently Asked Questions (FAQs)

What are the rules for delivery challan?

The provision of a delivery challan is controlled by CGST Rule 55 (2). It should be provided in three copies, as per the requirements. The original copy is for the consignee, ie the person who receives the goods, the second copy is for the transporter of the items, and the triplicate copy is for the consignor, ie the supplier of goods.

Is the mode of transportation detailed in the delivery challan format?

Yes, the mode of transportation chosen to convey the items should be specified on the challan.

Can I obtain a delivery challan if the items are transported from one warehouse to another in a different state?

Yes, a delivery challan can be used to transport items from one warehouse to another across state lines. You should also make sure that the format includes information about the warehouses.

What are the differences between a delivery challan and an invoice?

When items or services are supplied or when the supplier accepts payment, a GST invoice is produced. For the conveyance of goods, a delivery challan is given.

A delivery challan does not necessarily have to include the costs of the goods, but the tax amount is never mentioned.

However, the taxes levied on such goods and services are always shown on an invoice. Both the delivery challan and the invoice are often combined and referred to as ‘Tax invoice cum delivery challan.’

In GST, what is a Delivery Challan for job work?

A delivery challan is necessary when the principal sends items to a job worker, or when one job worker sends goods to another job worker, or when things are returned to the principal after job work.

Is it possible to create an e-way Bill for a Delivery Challan?

For the e-way bill to be generated, the delivery challan, invoice, or bill of sale and the transporter’s ID must be supplied.

What is a non-returnable delivery challan?

If the delivery challan is accompanied by a non-returnable gate pass, it helps the authorities realize that the products have been delivered completely and cannot be returned.

What is a returnable type of challan?

A returnable challan will be produced for items that are carried out of the warehouse for a specified reason and are expected to be returned soon.

6 Comments

Amazing post. Very interesting and informative.

Hello Rajesh,

Thank you for your warm words.

I’m glad to see that this article was informative for you.

Please let me know who is capable of producing an e-way bill.

Hello Shaswathi,

The e-way bill can be produced by the consignor or consignee in their capacity as a registered individual or a carrier of the goods. Unregistered transporters are permitted to register on the common portal and create e-way bills for the transfer of goods on behalf of their clients.

Anyone can sign up and create an electronic waybill for their personal usage for the transfer of goods.

Could you please explain in brief what a proforma invoice is?

Hello Sanjay,

A proforma invoice is a preliminary bill or estimated invoice that is used to ask the committed customer for payment prior to the provision of goods or services. A proforma invoice contains information about the items, the total amount due, and other specifics of the deal. I hope that was clear.